Unlike the formative years of banking industry when the range of solutions and the cost considerations were of extreme importance, the recent phase of mobile banking has experienced a shift of focus towards more personalization and rewarding user experience than ever before.

Unlike the e-banking websites, the proprietary banking apps offer a whole array of advantages, most importantly, the ease and flexibility of native user experience. Thanks to the proprietary banking apps, the service quality of the banks can be improved to a great extent and many regular tasks including the customer service can be automated. Both in terms of improving customer experience and attracting new customers, mobile banking app comes as the most effective finance banking solution.

Corresponding to the niche requirements of the baking and financial industry, there are certain ground rules and specific attributes that the banking apps today need to address on a priority basis. Considering these factors we brought here 7 pillars of banking app development.

1. Customer-Focused Security

For mobile banking apps, security should always be on top of the list of priorities. There are too many apps that in spite of being most successful in respect of customer engagement and appreciation remain terribly impoverished on security features and measures.

It is not just the programming and the code quality that give an app flawless security, it is also the factors like discipline in the development team, development process and meeting the time-tested security guidelines of the online and mobile banking that matter most. Any bank or financial institution when hiring a mobile app development service should keep this in mind. When millions are at stake belonging to people from all streams of life, you just cannot take chances on security measures. Security-first approach should be the backbone of any banking app.

Now, when it comes to banking security measures embedded in apps, there are certain considerations that you need to keep in mind. First of all, most people prefer using simple passwords, but multi-factor authentication as a security measure is already popular and many people prefer them instead of using complex and difficult to remember passwords.

Considering all these factors, let us mention here the tested and tried best practices for banking app security.

- Prevent storing security-sensitive financial information in the device storage of the user.

- Mandatorily use an SSL certificate for all kinds of communications between the server and the banking app.

- It is recommended to use cutting-edge security technologies such as biometrics or voice recognition.

- Ensure automatically logging off the user session in case of remaining inactive for a certain time.

- Mandatorily obfuscating the code of the app to ensure that no unauthorized access is allowed to the inner functions or the root code of the app.

- For every transaction and in-app activity sending text message notification to the users.

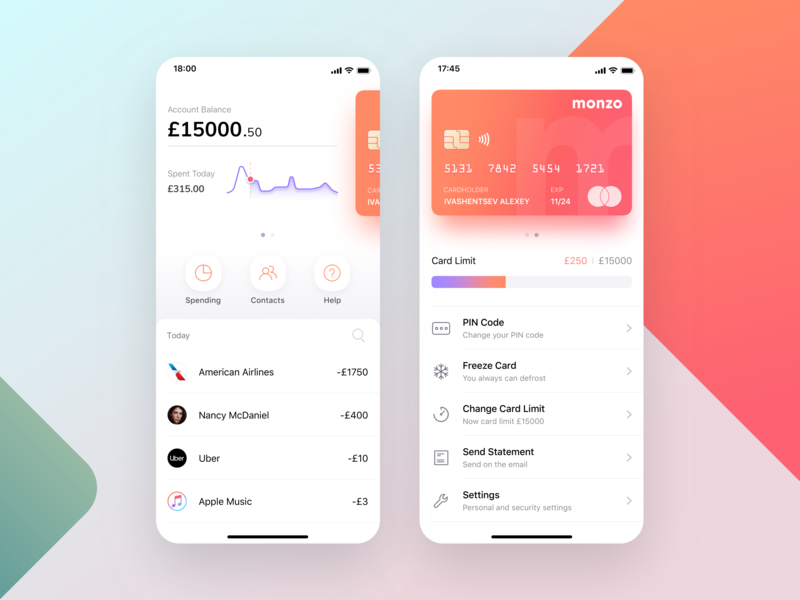

2. Personalized Customer Experience

A banking app unlike mobile apps of other niches needs to deal with a wide range of users belonging to different sections of the society. Now, every banking app user can have a certain kind of leaning and preferences for banking activities. But most banking app user prefer personalized user experience and menu options to do things effortlessly every time they open an app. This is why personalized user experience is something that every baking and finance app needs to give priority.

But, to give your banking app the edge of personalization, you must know the user preferences. This obviously requires conducting in-depth research of the customer activities and in-app behavior. You can at least allow users to personalize the menu options to help them with effortless user experience for most of the banking activities. Another important aspect of a personalized mobile banking experience is to deliver a highly responsive customer support service.

Let us mention here the key UX enhancements for banking apps to meet increasing demand of personalisation.

- Apart from allowing users with typical features to carry out mobile transactions and maintain accounts, offer the features that help them with physical banking outlets. For example, you can incorporate a GPS-enabled branch and ATM locator.

- Allow them turning some features on or off as per their preference. Allow them to customise the push notifications as per their preference. Apart from this, also allow them to add or remove features or menu options as per their preference.

- Implement geo-fencing based notifications to promote banking products and make offers at times when they are near a bank branch.

- Offer them personal financial advisory service right through the banking app.

- Include function to contact the respective bank branch with messages or to schedule an appointment with a bank executive.

- Apart from the features and functions, also allow your banking customers to tweak the look and feel of the user interface to a certain extent. A user can consider your app interface to be extremely boring and make provision for him to change the colour scheme and certain UI elements.

3. Stability and Performance

The processing power of a banking app is something that cannot be compromised. A banking app deals with tons of customer data. Apart from a humongous volume of data, a multitude of user queries with a variety of banking necessities makes things more complex. Naturally, the data processing prowess of an app should ensure optimum stability and performance. This requires the entire system to be capable of dealing with various amounts of data load.

Let us now point out some of the key tests to detect the stability and performance issues of any banking app.

- Load Testing is done to see the behaviour of the app under various data and processing load.

- Stress testing is carried out to see the optimum load the system can endure.

- Soak testing is carried out to see the consistency of the app’s performance while working under a certain workload.

- Spike testing is done to see the behavioural changes of the app in case of sudden spikes in processing load.

4. Competitive Excellence

Your banking app should also serve to your advantage to deal with the increasing competition in the banking industry. Every bank has some competitors in the market and from time to time they need to come up with measures that put their banking brand in advantage against the others in the race.

Does your banking app help you achieving a competitive edge? If not, let us help you with unique ideas and measures to reap competitive advantages through your mobile banking app. To begin with, consider incorporating some unique features that any of your competitor apps is still lacking. In terms of superior user experience also, try to address the shortcomings that other mobile banking apps generally have.

Considering all these aspects, let us mention here some of the key tips for achieving competitive excellence with your mobile banking app.

- Offer an ATM and branch locator feature to help your customers availing banking services through ATM and bank branches when they are out on the road.

- Provide a good expense tracking and budgeting tool that your customers can find handy and useful in all walks of life.

- Offer predictive money management features to give timely suggestions to your customers about managing their investments and accounts better.

- Create a wallet feature to help your customers doing transactions and managing withdrawals through QR codes.

5. Combining Offline and Online

These days providing offline access is a key attribute of smart apps. Technologically we are well-equipped to deliver both online and offline access for unified seamless user experience and this proves vital for many niche apps including that of finance and banking niche.

From providing offline access to information such as account balance to the capability of scanning a bill and processing it for future payments, offline access can do wonders to the user experience of a banking app. A banking app that allows depositing checks by just taking its image or a banking app that can fulfill KYC (Know Your Customer) requirements simply by taking snaps of personal documents, can really do wonders.

Obviously, to ensure offline access your banking app should be built for the native platform. It can be more expensive than the cross-platform or hybrid approach, but native development certainly has its own edge over others. Irrespective of the cost factor, if you can hire Android app developer and iOS developer separately for native development, that is definitely the right approach. Progressive Web Apps (PWA) can be a nice alternative with offline access to some contents, but for a rigorous and demanding niche like banking one should not compromise on the full-bodied features and capabilities.

6. Feedback and Support

Finally, even after doing everything right, you may not build an app that can satisfy vast majority of your customers. There will still be confused people who cannot interact with your app as smoothly as you figured it to be. There will be a considerable portion of customers who always feel confused about the app and instead of relying on the app for crucial transactions they prefer to visit bank and transact offline.

You need feedback from these customers and try to address the issues and shortcomings that are preventing them from online transactions. An inbuilt chat function within the app can actually work like a continuous helping hand to your customers. A responsive chat function can work as the always-awake customer support for your customers. The intelligent Chatbots equipped with Artificial Intelligence (AI) and Machine Learning (ML) have further brought automation into customer support through banking apps.

Conclusion

Since banking and financial industry is the perpetrator of growth and backbone of any economy, the technology-driven mobile banking apps will play a massive role not just for the finance and banking sector, but as a whole for every other sector that deals with financial transactions. These key considerations will continue to remain as the growth-hacking principles for the banking and fintech sector.