Sales require a streamlined, safe payment processing system. The Automated Clearing House, or ACH, is a secure network that facilitates electronic money transfers between bank accounts. For recurring payments like direct deposits and bill payments, this payment option is frequently utilized. ACH payments are a desirable alternative for organizations due to their many benefits over conventional payment systems.

It processes a lot of card and debit transactions, making it a flexible feature for digital transactions. This is the reason why a lot of banks, brokerages, and private retail companies have enabled this function for their clients. This has made it possible for its clients to get direct deposits and make on-time bill payments. Hire mobile app developers to get your ACH integration done successfully in the application for seamless payments.

Why is ACH Payment Integration Important for Mobile Finance Transactions?

Selecting ACH payments opens up several advantages that can improve the efficiency of your financial operations:

- Because the ACH network has several security levels in place, ACH payments are extremely safe. Since every transaction is encrypted, sensitive client data is protected and fraud risk is decreased.

- Because ACH transactions don’t have the same fees as credit card transactions, you may better deploy resources and maximize your income streams.

- Customers can pay bills without the trouble of writing checks or frequently inputting credit card information by setting up recurring payments. The entire payment experience is improved by this shortened procedure.

What is an ACH Payment API?

After discussing ACH payments, what is the connection between them and an API? Application program interfaces, or APIs, use specialized code created especially to handle requests such as payment processing. This API code, to put it briefly, contains all the procedures and protocols required to process online payments securely. Online credit card payments and e-commerce transactions, in general, need the use of API integration services. Multiple APIs are interoperable. For further security, a commercial website can, for instance, combine an authorization API with a payment acceptance API.

Developers can implement the coding necessary to support ACH transactions with the use of an ACH payment API. It establishes unique linkages between business, client, and bank accounts and establishes security measures for these ties.

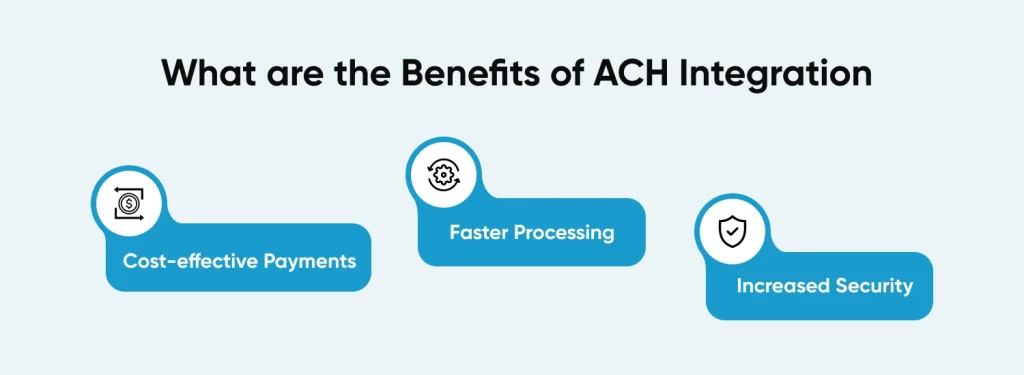

What are the Benefits of ACH Integration

Cost-effective Payments

The main factor influencing an increasing number of businesses to move to ACH payments is the cheap cost involved. ACH payments are frequently processed for free while using credit or debit cards requires a percentage fee equal to 2% of the total transaction amount.

Faster Processing

You have to wait for the check to clear before it reaches your bank if you accept paper checks. With practically instantaneous ACH processing, you can often get your transaction’s funds within a day. The management of your firm, from payroll to unforeseen expenses, depends on cash flow. You can meet the speed requirements of your organization with the aid of ACH processing.

Increased Security

Naturally, that comfort level is only useful if both parties believe that security requirements are being upheld throughout the transactions. Information is encrypted as soon as it is delivered through ACH transactions. An ACH transaction is conducted without exposing the banking information to multiple people handling a paper cheque. Data theft is rarely a possibility with any payment method.

What are the Technical Aspects of ACH Integration?

How does ACH work in the Mobile Wallet Application?

Even though there is a mobile payment processing alternative, ACH payment processing is safer because it is electronic. Accepting ACH mobile payment processing makes sense for businesses to guarantee substantial savings. All you need for this is a routing number and a bank account. There is no need for credit cards, cash, or checks. eWallet app development with ACH is distinct from other electronic payment methods, such as wire transfers, debit and credit cards, e-checks, and electronic funds transfers, or EFTs.

What are the Steps Involved in Implementing ACH integration?

ACH payments can speed up your cash flow regardless of the sector you operate in. The cheaper cost of ACH over conventional wire transfers is an additional advantage.

For a seamless and simple onboarding process, you should adhere to the procedures listed below when setting up ACH payments for your company. You can also read our blog on how to integrate a payment gateway in an app to understand how different payment gateways work and help in business growth.

NFC is a technology that ensure contactless payments with ACH integration. Google App Pay, Square Wallet App, and PayPal are all examples of the best NFC payment apps for tap and pay that involve API integration for payments with ACH.

Step 1: Create an Account for ACH Payments

To begin receiving B2B ACH payments, you must first create an ACH payment account. However, you need to select the best payment processor for your transaction processing before creating your ACH payments account. The following paperwork is required to complete the setup form:

- Verification of the business address

- The owners of the company’s valid ID

- Federal tax identification

- Calculated processing volume estimates

Step 2: Choose an ACH Payment Processor

Speak with your bank about the processing fees when selecting a payment processor for your ACH payments account. It is advisable to evaluate several operators based on the specifics of their characteristics and select the optimal one based on your company’s requirements and preferences.

Step 3: Finish the Documentation and Send in Your Payment Information

There are numerous additional terms and restrictions related to ACH payments that you will encounter when you fill out your business details. It is recommended that you thoroughly read all of the information and proceed with caution. You must abide by all guidelines and policies set forth by the payments provider if you decide to work with an ACH payments operator.

What are the Security Measures to Consider?

Security precautions must be taken to protect this data because there are many moving components involved in money transfers across the ACH Network and using APIs.

1. To Prevent Attacks on ACH transactions

To become an ACH Operator, a financial institution must receive approval from the ACH network. This implies that the financial institutions looking to enable these transactions will need to have security measures in place beforehand, such as encrypting the transaction.

Fortunately, the National Automated Clearing House Association (NACHA) has already put laws in place. The non-profit organization NACHA is in charge of overseeing, managing, and enabling the ACH Network.

2. To Mitigate ACH transaction attacks

Your financial cybersecurity awareness will need to be continuously improved to lessen the impact of an attack on an ACH transaction.

Identify supply chain management (third parties), asset management, corporate environment, governance, risk assessment, and risk management plan. Protect Data security, information protection processes and procedures, maintenance, protective technology, awareness and training, access control, and identity management.

3. To Transfer ACH Payment Data Securely

Three recommended practices-authentification, authentication, and authorization-are used in ACH transactions to secure the transmission of payment information.

Encryption is the process of ciphering and decoding data by running the characters via an algorithm that is key-locked. Anyone with key access can decipher the ciphered text because the data is unlocked using the same key and another algorithm. Another way to get encryption is through cryptocurrency transfers.

4. For the Security of ACH Payment Data

It is essential to your operation as a financial institution to offer secure storage for both electronic payment data and sensitive financial information.

Here’s how to carry that out:

- Use PCI-approved hardware and software to store data.

- Use only authorized service providers that have undergone rigorous testing (conducted by a QSA; refer below). It bears the designation PCI-DSS Validated Entity.

- Do not keep track of electronic track data or card security numbers.

- Encrypt any electronic data stored about credit card accounts and cardholders.

- Encrypt phone calls that include information about credit card accounts.

To determine whether the way you store payment data complies with PCI standards, you can complete the relevant self-assessment form. In addition, you must annually maintain PCI-DSS compliance with the Quality Security Assessor (QSA) and Approved Scanning Vendor (ASV) and complete the Attestation of Compliance (AOC) form to be PCI compliant.

User Experience Enhancements

Payment gateway API integration or application programming interfaces, let developers combine different systems to create customized payment solutions for different types of businesses. For instance, developers use plugins and APIs to construct eCommerce-embedded payment sites that are customizable.

There is a greater chance of making more money when customers have more options on how to pay. This is particularly true for payment technologies that may be processed online or through the Internet, enabling payments to be made at any time and from any location. With the growth of global e-commerce, businesses will be able to reach a wider audience and provide safe payment options wherever they are with borderless payment processing. Reduced merchant hassle and increased consumer convenience are provided by the experience and assistance of a reputable payment processor.

Trends and Innovations

Application Programming Interfaces (APIs): Due to their ability to provide smooth integration and communication between various financial systems and outside services, APIs have emerged as the foundation of contemporary digital banking.

This technology improves service delivery and end-user happiness by enabling more adaptable, scalable, and customizable banking experiences. According to the report, 79% of the schools polled have already implemented APIs, and 14% more say they intend to do so this year.

Robotic Process Automation (RPA): By automating repetitive and routine operations, RPA technology raises efficiency and lowers the possibility of human error. According to the study, RPA tools have been implemented by 70% of institutions, and another 21% aim to do so shortly. This indicates that RPA technology is quickly becoming a crucial part of the financial services operating ecosystem.

Artificial Intelligence and Machine Learning in Banking: To transform data analytics in banking, machine learning technology is essential. It drives sophisticated predictive models and algorithms that improve risk assessment and decision-making. According to the survey, 42% of institutions have implemented machine learning. By the end of 2025, it is anticipated that this percentage will have increased to over 50% as more institutions become aware of the potential advantages of artificial intelligence in banking.

The Future of ACH

With the increasing need for speedier digital payments, ACH payments are about to undergo a significant transformation. What knowledge is necessary to be ready?

Instant Payments is Here

More financial institutions are starting to offer instant payments, which are usually associated with peer-to-peer payment platforms like Venmo. To provide access to fast payment features, the Federal Reserve’s FedNowSM Service will introduce 24/7 real-time money availability in 2025.

In the end, this will encourage innovation throughout the payments industry. To increase productivity and maintain their competitiveness, “nine in ten businesses expect to be able to initiate and receive faster payments,” according to PYMNTS.com. It will help you prepare if you consider your payment approach in advance.

Conclusion

The future of business as we know it lies in digital payments. The frequently unpredictable changes in contemporary corporate operations may be resolved by implementing cutting-edge ACH payment technology solutions. It might also be the best approach for companies to meet the demands of younger, more tech-savvy consumers as their purchasing power increases. You may provide your clients with seamless payment processing with the newest payment technology solutions, supporting their businesses.

Contact the best mobile app development company immediately if you’d like to work with a payment solutions provider that can deliver an all-in-one solution and a long-lasting, seamless payment experience in the digital economy.

Frequently Asked Questions

Is ACH Integration Secure for Mobile Transactions?

Because the ACH network has numerous security layers in place, ACH payments are extremely safe. Since every transaction is encrypted, sensitive client data is protected and fraud risk is decreased.

How to Integrate ACH into Your App?

Step 1: Setup your ACH payment account.

Step 2: Select an ACH payment processor.

Step 3: Complete the compliance and mention the payment details.

How to Integrate with ACH for Bank-to-Bank Transfers?

Online ACH payments can be made via the website or mobile app of your bank or credit union. Sometimes you can pay a bill using an ACH transfer; to do this, you’ll need to give the merchant your account number and your bank’s routing information, either through their app or website.

How Can ACH Integration Enhance User Experience in a Mobile Wallet?

When ACH payment integration is combined with credit card transactions, it can drastically lower credit card decline rates and save expenses. By incorporating ACH payment options, SaaS platforms can draw in new customers and gain a competitive edge. SaaS systems may be able to add new revenue streams through the integration of ACH payments.

How Does ACH Integration in a Mobile Wallet Contribute to Business Growth and Customer Satisfaction?

ACH API payment methods provide a financially sensible substitute by reducing transaction costs related to conventional payment methods. Lower transaction costs enable companies to deploy resources more effectively and directly lead to higher profit margins.