Real estate gives you a lot of options to see and analyze properties online. As real estate is all about location, some websites give you these details with the competitive aspect of real estate marketing. To remain competitive, businesses get the best real estate app ideas and want software solutions that can analyze huge volumes of data while simultaneously scaling to meet expanding customer demands and market complexity.

To build a real estate analysis integration solution, enterprises effortlessly process, analyze, and act on data from a variety of sources, including AI in real estate, Multiple Listing Services (MLS), GIS systems, IoT devices, and public records. These tools can help firms by delivering actionable data in real-time, optimizing decision-making, and automating important operations.

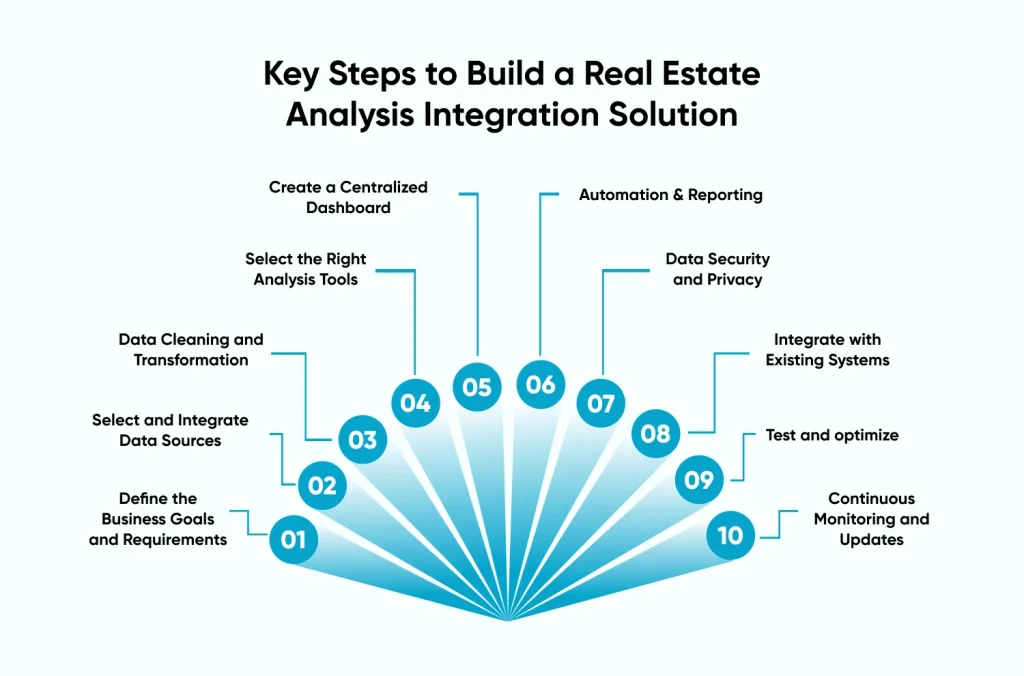

In this step-by-step approach, we will go over the intricacies of incorporating real estate analysis integration. From concept to final implementation, this comprehensive guide aims to provide a roadmap for seamless real estate investment analysis to ensure efficiency, accuracy, and performance, thereby increasing the capacity of the active asset management insights to successfully validate the key and provide instruction.

Whether you are an experienced real estate business owner or new to the sector, this guide will be a helpful resource for you, providing insight and assistance on how to make the most of cutting-edge technology in your real estate activities.

What is the Biggest Challenge in Real Estate?

The industry is dealing with massive amounts of data generated by technology solutions. However, this data is often siloed. With so much data available, let us analyze some of the difficulties that real industry faces, as well as the tactics that might be used to address them.

Lack of Emphasis on Technological Transformation

Most real estate firms lack the vision and structure to make data- and technology-driven decisions. According to a consulting real estate firm survey, the majority of professionals leading digital transformation in real estate companies do not have a technical background. A sizable proportion come from real estate, construction, or banking backgrounds. Companies must have a distinct strategy to their business areas (building, buying, and selling real estate, brokerage, advisory, etc.) and have the necessary people to guide it.

Real Estate Data Integration

A successful real estate market analysis solution requires robust real estate data integration. By linking data from MLS, public records, GIS systems, and economic indicators, businesses can ensure that all critical data points are available for analysis in real time.

Data disparity and Fragmentation

Real estate organizations are striving to harness the power of data both within and beyond their ecosystem. The industry collects data from internal operations such as facility management and sales analytics, as well as external data such as rental and inflation rates from federal agencies and industry data from market aggregators. In an ideal world, every real estate company would like to have all of this data connected and cleaned so that insights can be generated more quickly.

However, companies struggle to collect and interpret data. Outdated spreadsheets for data repositories, poor data skills of employees, lack of standardization, and complex privacy regulations are some of the issues to be addressed to harness the potential of integrated data.

Limited Third-Party Data

When it comes to third-party dataset availability, real estate enterprises typically have few options. The real estate data processing market is highly fragmented, with most enterprises relying on their in-house teams or local brokers and consultants to acquire information. Only a few organizations provide full information and analytics solutions for most commercial real estate components. These companies have limits in terms of geography covered, data metrics availability, and the inclusion of appropriate assets.

The industry needs third-party dataset providers to help them uncover data shortages and meet their needs.

Key Steps to Build a Real Estate Analysis Integration Solution

1. Define the Business Goals and Requirements

Determining the precise demands and goals of the organization is essential before you start creating the solution. Are you examining market trends, investment opportunities, property values, or all three? Knowing your real estate market analysis integration solution’s objectives will help shape the system’s functionality and design.

2. Select and Integrate Data Sources

Real estate analysis solutions rely significantly on reliable and up-to-date information. You must discover and integrate credible data sources, such as property databases, best real estate APIs, MLS (Multiple Listing Services), public records, and economic indicators. Consider combining real-time data from several sources, such as property listings, previous transaction history, market trends, and geographic information.

3. Data Cleaning and Transformation

Real estate data governance ensures the data used is accurate and consistent and complies with regulations. It involves setting standards of data collection and storage to generate actionable insights.

4. Select the Right Real Estate Analysis Tools

Next, hire dedicated developers to select the appropriate real estate analysis tools. The intricacy of the study and the degree of automation required will dictate the technologies you employ.

5. Create a Centralized Dashboard

An important part of the dashboard’s success is real estate data visualization. By using tools like Tableau and Power BI, businesses can turn complex data into clear, actionable visual insights, enabling stakeholders to interpret trends, property values, and market performance. The dashboard should include:

- Property value models are dynamic and based on real-time data.

- Charting market trends, rental yields, and appreciation rates.

- Investment calculators are tools that help people analyze their investment potential.

- Display property locations and market data spatially to aid decision-making.

6. Automation and Reporting

Automation is critical to improving efficiency in real estate analysis with the help of Web3 technology in real estate. Setting up automated reporting systems allows you to generate insights regularly or in response to user requests. Automated notifications can advise stakeholders of significant market developments, new investment opportunities, or fluctuations in property prices.

7. Data Security and Privacy

Given that real estate data frequently contains sensitive financial and personal information, real estate data security is critical. Use industry-standard security protocols including encryption, secure authentication, and data access controls. Protecting your data from illegal access will help you develop user confidence while also complying with privacy rules.

8. Integrate with Existing Systems

We ensure that your real estate analysis integration solution works with your current company systems and software, such as CRM systems, property management tools, and accounting software. Seamless integration allows your analysis solution to operate smoothly inside the larger technology environment, providing a consistent user experience.

9. Test and Optimize

Before deploying your solution, we thoroughly evaluate it to ensure correctness and usability. We test the Real estate analytics platform with real users to find issues and opportunities for improvement. We also improve the performance of your analysis solution so it can handle massive datasets and real-time queries without lagging.

10. Continuous Monitoring and Updates

Once your real estate analytic integration solution is operational, it is critical to regularly monitor and upgrade it in response to user feedback, changing market conditions, and technology improvements. Keep the data up to date, alter your models as needed, and ensure that your platform can react to new business requirements or legislation.

What are the Benefits of Using a Real Estate Analysis Integration Solution?

The popularity of Real Estate software solutions can be understood by the stats provided by Grand View Research, where the global real estate software market size noted an evaluation of USD 10.24 billion with the possibility to grow at a CAGR of 12.8% between 2023 to 2030.

- Improved operational visibility and control

- Data sharing that is smooth and centralized

- Automation of business processes

- Risk reduction from human mistake

It is no secret that data is essential to decision-making. But methodology counts: how you extract, transform, store, aggregate, and visualize your data has a direct impact on most business operations and the strategies developed around them.

Businesses in the real estate industry handle vast amounts of diverse data that are gathered from a vast array of sources. Their search for methods to automate the data management process and boost its overall effectiveness is prompted by this specialization.

Why Choose CMARIX as Your Top-notch Real Estate Software Development Company?

When you hire dedicated developers from CMARIX, we assign you developers with previous experience in the real estate industry. Hence, you won’t need to worry about compliance, technicalities, or any other such issues.

Industry Expertise

Our dedicated developers bring years of experience in the real estate sector, offering deep insights into industry-specific challenges and opportunities, and helping you build solutions tailored to your business needs.

Custom Software Solutions

At CMARIX, we specialize in providing bespoke software solutions designed to optimize your real estate operations, enhance user engagement, and streamline your workflows for maximum efficiency.

Last Mile Support

We offer last-mile support throughout the entire software lifecycle, ensuring that your real estate solution remains scalable, secure, and up-to-date with the latest industry trends.

Conclusion

In a field where decisions are based on data, developing a scalable real estate analysis integration solution is essential to maintaining competitiveness. Businesses can build reliable systems that adjust to shifting needs by utilizing contemporary tools, implementing a microservices design, and concentrating on real-time analytics.

Investing in a scalable solution guarantees that you can handle big datasets, provide useful insights, and enhance user experiences, regardless of how old your company is. You may create and deploy a bespoke solution that supports your business objectives with the assistance of a real estate software development company in the USA that specializes in real estate data analytics services. To fully utilize real estate analysis for your company, begin developing your solution right now.

FAQs For Real Estate Analysis Integration Solution

What are the key components of a real estate analysis integration solution?

Strong data integration frameworks, scalable cloud infrastructure, and effective database design for both structured and unstructured data are all components of a real estate analytic integration solution. It makes use of microservices architecture for flexibility, real-time analytics tools for immediate insights, and security and industry compliance.

What database technologies are best suited for real estate data?

Real estate data can be stored in a variety of database technologies, such as client relationship management (CRM) databases, property listing databases, transaction databases, market data databases, and geographic information systems (GIS).