Emerging technologies like blockchain, AI, and machine learning are causing a tremendous disruption in the financial software development services sector. A new era in finance known as WealthTech, or wealth management technology, is being ushered in by this wave of innovation. Its goal is to improve financial advising and asset management services by utilizing these technologies.

FinTech in wealth management aims to improve the client experience, increase efficiency, and lower costs across the whole value chain. It includes a wide range of products, such as client analytics, portfolio management software, and robo-advisors.

Institutions and final clients stand to gain much from the use of these technologies by traditional finance. This blog will provide an overview of WealthTech app development, the key benefits it offers, and use cases of WealthTech in financial innovation.

What is Fintech Wealth Management?

WealthTech transforms the way assets and finances are managed by fusing technology in wealth management. It enhances investing and personal finance by utilizing advancements like blockchain, machine learning, and artificial intelligence. WealthTech developers build a financial planning software that uses artificial intelligence (AI) to generate personalized financial suggestions and automate laborious wealth management procedures.

Wealth managers’ burden is lightened as a result, freeing them up to concentrate on high-value services. FinTech wealth management solutions help users make better-informed decisions about wealth planning, budgeting, and investments.

FinTech wealth management solutions use risk reduction and wealth optimization by analyzing financial data. They also make it simple for customers to keep an eye on investments, track budgets, and receive performance alerts. WealthTech uses intelligent automation and data-driven strategies to make asset and money management more accessible, efficient, and customized.

Adopting these technologies results in improved services and outcomes for clients as well as management. An intriguing trend towards more approachable, efficient wealth management software development is represented by wealth tech.

3 Main Categories of Fintech in the Wealth Management Industry

According to McKinsey, there are three primary archetypes within the wealth management technology (WealthTech) business that their customer service approaches can distinguish:

Direct-to-Consumer WealthTechs (D2C): Digital platforms that offer investment management and guidance to retail investors throughout the wealth spectrum are known as direct-to-consumer wealth technologies or D2Cs. They provide access to both private and public assets, such as real estate and startup investments mutual funds, and exchange-traded funds (ETFs). D2C WealthTechs wants to make affordable, simply accessible personalized financial advice available to a wider audience.

WealthTech Companies Offering Financial Institutions Their Solutions (B2FI): These business-to-business wealth tech companies offer the tools traditional financial institutions need to modernize their asset management services. Front-end client portals and back-end value chain linkages are examples of solutions. Institutions can update individual services or the complete wealth management process with modular platforms.

WealthTech Companies that Offer Financial Advisors Solutions (B2FA): The goal of this sector is to provide financial advisors with digital tools so they can service clients more effectively. Enhancing adviser capabilities and providing customers with a smooth digital investment tracking experience are the goals of the solutions. Because the systems automate administrative processes, advisers may devote more time to providing client support.

Using technology to provide more people with access to wealth management services through user-friendly, cost-effective platforms is a major trend. WealthTechs are shifting to fee-based contracts.

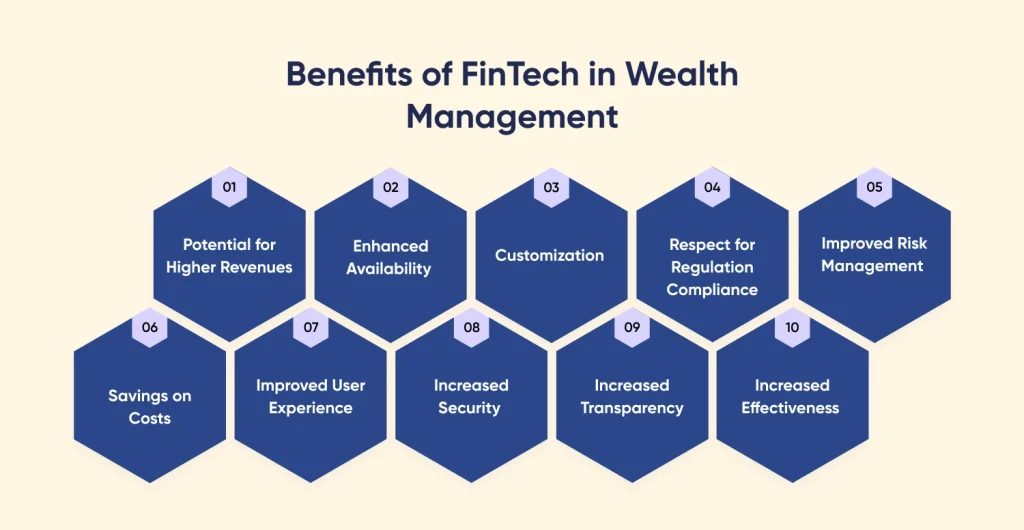

Benefits of FinTech in Wealth Management

Traditional methods are being revolutionized by wealth tech, which is increasing their automation, accessibility, and transparency. These are WealthTech’s top ten advantages for businesses and end customers.

Enhanced Availability

By removing obstacles set up by traditional brokers, such as high account minimums, limited geographic service areas, and the requirement for in-person interactions, wealth tech increases access to financial services. Prominent robo-advisors such as Wealthfront and Betterment, for example, just need a few hundred dollars to open and manage accounts using mobile and web platforms that are easy to use and accessible from any location. Retail investors now have equal playing fields as a result.

Customization

WealthTech solutions can offer customized product recommendations and portfolio allocations that are in line with each investor’s financial objectives, risk tolerance, and liquidity requirements thanks to sophisticated algorithms and large datasets. By adding even more personalization to the experience, contextual cues and notifications improve user engagement. Regarding FinTech within the wealth management ecosystem, these technologies provide investors a substantial chance to leverage data to make better-informed decisions.

Savings on Costs

By utilizing process automation and artificial intelligence, FinTech wealth management solutions automate a significant portion of trading execution, portfolio management, advisory services, and operations. This considerably lowers the requirement for costly infrastructure and human advisors. Web and mobile delivery options also reduce the cost of distribution. By passing on the resulting cost savings to end customers, services become more cheap.

Improved User Experience

Prominent WealthTech applications have engaging user interfaces with a sleek, simple design. Instantaneous transaction alerts, dynamic dashboards, unified financial data views, flexible online account opening, and smooth advisory chatbots enhance user experiences.

Increased Security

WealthTech is far more resistant to data and financial threats thanks to features like biometric login verification, required multi-factor authorization, end-to-end encryption, distributed ledger technology, centralized data monitoring, and sophisticated cybersecurity infrastructure. When compared to older systems, security is increased.

Increased Transparency

An unparalleled level of openness about holdings, investment performance, strategies, fees, and impending financial actions by their providers is made possible for investors through wealth platforms that integrate open API architectures, personalized notifications, interactive dashboards, and automated reporting.

Increased Effectiveness

Operational productivity is significantly increased by streamlining wealth management procedures through automation and AI-powered improvements. This results in fewer errors, quicker transaction processing, fewer information requests, and rapid client base expansion without corresponding increases in costs.

Improved Risk Management

To better assess and manage risk, wealth tech apps have modules for exposure calculation, cash flow modeling, portfolio stress testing, and scenario analysis that make use of data science and predictive analytics approaches. This is a crucial component because proposing investment products with intricate, leveraged structures is a requirement for wealth.

Potential for Higher Revenues

WealthTechnology firms use flexible, API-based platforms that give them the flexibility to introduce new collaboration channels and real-time visibility into client activities. This encourages quicker innovation and the capacity to seize changing income opportunities that other companies would pass on.

Respect for Regulation Compliance

There are significant productivity gains in adhering to rules such as AML (Anti Money Laundering) and fiduciary standards when compliance operations like KYC (Know Your Customer) verification, transaction monitoring, and risk rating are integrated into account opening and advice workflows.

Features to be Integrated in a WealthTech App

To make financial management easier and more enjoyable for today’s smart investors, WealthTech apps provide a variety of functions.

- Personalized investment plans, automated investment portfolios, and real-time market information are all provided by automated portfolio management.

- Financial planning offers all-inclusive instruments for long-term financial projections, savings programs, and efficient budgeting.

- Systematic Tax Administration.

- includes tools for extracting tax losses, tax-saving investment methods, and thorough tax planning.

- Retirement Planning Techniques.

- For effective Social Security and retirement planning, utilize resources such as retirement savings calculators and customized investment advice.

- Portfolio monitoring.

- Real-time portfolio performance monitoring, including risk assessment and market trend adherence, is made possible via portfolio monitoring.

- Support Services.

- 24/7 customer assistance and access to financial consultants to help you make wise financial decisions.

- Data security.

- Uses the best security procedures to protect user investment and financial information.

- Financial Analytics.

- Custom financial reports and performance monitoring for investments are made possible by advanced reporting and analytics features.

- Establishing and Monitoring Goals.

- Gives customers the ability to create financial objectives, track their progress, and receive inspirational insights and accomplishments.

- Seamless Integration.

- enhances simplicity and efficiency by seamlessly integrating with other financial services and tools to provide a comprehensive picture of personal finances.

How to Develop a Wealth Management App?

Developing a wealth management fintech startup that satisfies the changing demands of modern investors demands careful planning and state-of-the-art technology for application. Let’s explore the crucial actions and factors to take into account while developing an app that sticks out in the crowded WealthTech market.

Step 1: Compiling the Needs

Clearly defining the app’s requirements based on an in-depth analysis of the target user base’s wants, goals, and pain areas is the first stage. This could entail usability tests, interviews, polls, and more. The following are some typical prerequisites for developing wealth management apps:

- Tracking a portfolio across several assets and accounts

- Automated rebalancing and management of investments

- Calculators and tools for financial planning

- AI-powered customized suggestions

- Funding and money transfers into secure accounts

- Data visualization and interactive reporting

Step 2: Prototyping and Design

The design of the user interface (UI) and user experience (UX) comes next in the development of wealth management software after requirements have been specified. This includes:

- Developing prototypes, wireframes, and user flows

- Specifying the visual style manual

- Constructing interactive prototypes for user evaluation

- Modifying the designs in response to criticism

Step 3: Creating an App

Once the designs and requirements have been finalized, the development team may move forward with creating the WealthTech app. Important choices must be made at this stage of the wealth management app development process, including as choosing the right tech stack, which frequently includes cross-platform frameworks like React Native for smooth platform deployment. The application is designed to have access to the required financial data and services by implementing integrations with third-party data providers and APIs.

Step 4: Backend Integration

For WealthTech apps to integrate with current financial systems and services without a hitch, they need strong back-end connectors. This could entail setting up scalable cloud infrastructure to support the app’s computational needs, connecting to the implementation of Enterprise CRM solutions and current advisor tools, integrating with trade execution and portfolio accounting platforms, and establishing connections with banks and brokerages via APIs for account aggregation.

Step 5: Security & Compliance

When developing new programs, financial companies have to strictly adhere to tight security and privacy regulations. This entails abiding by financial adviser rules, preserving customer data by regulations such as GDPR, extensively testing for security reviews and breaches, and logging operations to ensure that requirements are followed.

Step 6: Launch, Testing, and Continued Assistance

The WealthTech app will go through testing and development stages before being made available to consumers via app stores. However, the development team’s effort doesn’t end there. The success of the app depends on ongoing support and maintenance, which includes performance monitoring, problem fixes, FAQ assistance for customers, feature enhancements based on user data, and frequent updates to accommodate changes in the system and new requirements.

The Future of Wealth Management Technology

WealthTech appears to have a very bright and transformational future. These are a few of the major advancements and trends in WealthTech that will influence WealthTech in the FinTech space in the upcoming years.

AI-Powered Hyper-Personalization

A previously unheard-of degree of hyper-personalized wealth management technology services will be made possible by artificial intelligence and machine learning. AI software development and its smart algorithms will be able to deliver highly personalized advice, recommendations, and portfolio management by thoroughly understanding each client’s financial condition, goals, risk tolerance, and preferences.

Digital Immersions

Immersion technologies that change the way investors connect with their advisors, engage with their portfolios, and manage their finances include gamification, virtual and augmented reality, and interactive data visualization.

Conclusion

WealthTech, which uses digital technologies, artificial intelligence, and data analytics to provide efficiencies and development opportunities, is quickly changing wealth management in the FinTech sector. Selecting the appropriate technology partner becomes essential as the industry develops. Hire dedicated developers from CMARIX. With its strong FinTech competence in AI, compliance, and other areas, may be your committed partner for WealthTech development.

CMARIX, a top FinTech app development firm, can assist you in creating a strong and profitable WealthTech application by drawing on its vast experience and in-depth knowledge.

Speak with our team of experts to create a customized WealthTech solution that fulfills all of your requirements.

Frequently Asked Questions

What Is Fintech Wealth Management?

Innovation in technology used in the creation and provision of financial services and goods is referred to as “fintech.” Large-scale dataset analysis, analytical methods, automated trading, automated advice, and financial record keeping are all areas of fintech development.

What Is the Difference between Wealth Tech and Fintech?

The primary distinction between the two markets is that WealthTech products usually concentrate on managing the assets and investments of wealthy people. FinTech software development services, on the other hand, are more extensively focused on offering services to corporate and consumer clients.

What Impact Has Fintech Had on the Wealth Management Industry?

By utilizing process automation and artificial intelligence, FinTech wealth management solutions automate a significant portion of trading execution, portfolio management, advisory services, and operations. This considerably lowers the requirement for costly infrastructure and human advisors. Web and mobile delivery options also reduce the cost of distribution.

How Long Does It Take to Develop a Wealthtech Product?

The basic FinTech application takes approximately 3-6 months. The period required to construct a FinTech app can range from 12 to 18 months, depending on the complexity of the project, the requirements, and the FinTech application development options you select.