All companies may benefit from digitization, which is just another word for modernity. Although it may not seem like it, managing money is essential for every business. Good financial planning might mean success or failure for a company. Technology is a vital part of every modern enterprise. By fusing the two concepts, “Fintech” has proven to be an invaluable tool for businesses in a wide variety of industries, allowing them to better manage their finances and anticipate and prepare for the future.

It is generally known at this time that the use of proper software may simplify, accelerate, and enhance Custom financial planning software. Digital transformation is hastening the process of improving and simplifying one’s personal financial plan. As a result, there will always be a need for new financial planning software. Allied Market Research projects that the worldwide market for financial planning software will grow from its 2021 valuation of $3.7 billion to $16.9 billion by 2031, representing a CAGR of 16.6%.

The Custom financial planning software market is expected to shift its focus from the services industry to that of solution provision. The explanation for this is straightforward: during the epidemic, financial advising businesses communicated with their customers primarily via social media. Because of this, there’s a pressing need to create tools that keep financial advisors and investors informed of the latest market trends and changes.

Using the client’s risk tolerance and desired financial outcomes as guides, the financial planning solutions will determine whether or not an investment is a good fit.

What Is a Custom Financial Planning Software?

The term “Custom financial planning software” is used to describe programmes that aid in the process of budgeting by using all of an individual’s or a company’s accessible financial records to get the appropriate analytical output. The programme may be used for a wide range of purposes, and the data it processes can come from a wide variety of sources, including but not limited to financial transactions, investment monitoring, bank records, portfolio management, and many more.

The financial planning firm saw the need for software that could monitor and control client revenue in light of the dramatic increase in the firm’s HNI customer base. Customers are also looking for ways to use mobile apps to monitor their assets and wealth. Businesses nowadays need solid financial planning software that can efficiently manage their ERP and provide excellent customer service if they want to prosper. In addition to these benefits, solid financial planning software makes it possible to manage the information.

How to Build a Financial Planning Software?

While it is not an exact science, developing a comprehensive personal financial plan requires a number of elements in the correct proportions. When establishing these plans, financial advisers must handle a range of pain points, such as whether they should meet a particular customer demand or give a broad template for a genre of clients.

They should remember to give customised personal financial strategies that bring value to their customers. The strategy should be built on stronger growth and long-term profitability. Before putting the plan into action in real-time, all components of the approach must be thoroughly reviewed with the customer. Here are some considerations for financial advisors:

- It is critical to discover the primary reason behind the client’s desire to conserve money. Clear financial objectives must be established as a result.

- A monthly cash flow and a savings or investment strategy must be the next elements to consider when developing a budget.

- Potential income tax credits and deductions must be considered while budgeting for taxes.

- An emergency fund should be put up for case unforeseen situations arise.

- A debt management worksheet should be used to track the client’s finances and manage debt.

- A strong financial plan should include a record of disability and life insurance coverage to detect any gaps.

- The financial adviser must assist the customer in planning what they want to do with their money after they retire, as well as provide long-term investment possibilities.

What Should Be Included in an Effective Financial Planning Software?

By giving their customers open and honest analyses and regular updates on their financial planning plans, financial planning adviser businesses aim to provide clients with services that are of high value. Having reliable financial planning software is crucial for meeting the rising demands of both customers and the market. In order to be considered state-of-the-art, Custom financial planning software must provide the following essential features:

Connect to a Database of Investment Returns

The state of the investment market has an immediate impact on the outcomes of any financial plan. The success of their market investments is an important determinant of the quality of financial planning software for financial advisors. You may get a better understanding of what it will take to attain your investing goals by comparing the investment’s growth rate to that of the market as a whole.

Effective Processes

In addition to helping their customers with investment strategies and portfolio management, financial planners must also take care of the business of running the firm itself. Financial planning firms may better serve their customers by reducing their internal operations. Consequently, it is essential that the software you use for financial planning be both straightforward to learn and use. Data collection, suggestion making, portfolio management, and other similar tasks should be as painless as possible.

Personalised Interaction

The software business has shifted to become very used to individualization. The financial planning software should, at a minimum, provide editable reports and automatic suggestions based on AI. Good Custom financial planning software is characterised by its capacity to provide individualised reports that detail each client’s financial history.

How Do You Create Software For Definitive Financial Planning?

Comprehensive financial planning necessitates the use of cutting-edge software by financial advisers. Financial planning software is simply a set of algorithms that work together to plan cash flow and compute costs as one engine.

To design the best custom financial planning software, financial advice firms might consider the following suggestions:

1. Determine the Software Type

Personal financial planning software must be compatible with the sort of planning assistance that the organisation wishes to provide to its customers. Planning guidance may be divided into two types: goal-based and cash-flow-based. Recognizing the complexity is the first step in designing planning software. Clients’ income and spending would be tracked in relation to their financial objectives using goal-based software.

It would also determine if the client’s existing financial plan can assist them achieve that objective and examine improvements that can. Cash-flow-based software, on the other hand, would clearly monitor all of the customers’ revenue, spending, savings, and so on, as well as every detail.

2. Client-Centred Enhancements

Investigating every facet of what a client needs is a critical step in building the finest tools for their financial objectives. Personal financial planning software should enable advisers to easily locate new customers and engage them in meaningful ways. It is critical to cater to each kind of customer differently, depending on whether they are high-net-worth individuals or novice investors. Furthermore, the software should match the intended results of the adviser with the end-client experience.

3. Module for Financial Plan Delivery

In an industry that favours paperless means of service delivery, customers of financial advisors are likewise pushing toward service digitalization. If personal financial planning software can give plans to customers through client-facing mobile apps, the number of downloads and use of such software would skyrocket. It is simpler for customers to understand and use personal financial plans when they can examine them via straightforward and interactive dashboards and scalable graphics.

4. Platform Ignorance and Plugin Options

Incorporating platform agnosticism into a personal financial app development would significantly increase the amount of views and downloads. Advisors may connect directly with customers with varying degrees of technical proficiency using software available on PC, mobile, and other platforms. This amount of technical complexity would also influence how the financial advice would construct its solution.

The expenses of using multiple open-source dependencies to improve the platform-agnosticism of the final solution would be somewhat more as well, but the benefits would be larger.

5. Services to Assist

Client portals and account aggregation, for example, may improve the usability of personal Custom financial planning software significantly. This would also lessen the amount of manual work that a financial counsellor would have to do. Different software packages inside the programme should be able to exchange data freely.

Advisors should be able to retrieve information from supplementary libraries for use in planning. More thorough reporting and simulation analysis for the plans are two further features that may be obtained using auxiliary software plug-ins. To anticipate the likelihood of each occurrence, a set of potential possibilities is examined. These are more effective approaches than straight-line analyses on a flat return.

6. Security Features

Because most financial advice platforms use cloud technology, it is more important than ever to keep client data digitally safe. To give many levels of protection to the client’s financial information, strict security standards such as two-factor authentication must be applied.

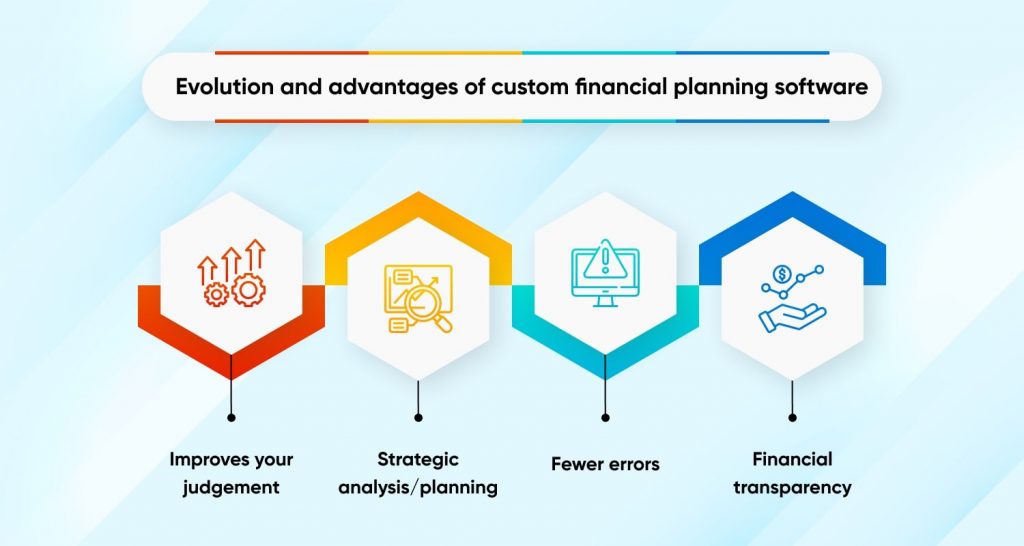

Evolution and Advantages of Custom Financial Planning Software

Traditional Custom financial planning software consisted of nothing more than a calculator that let advisers evaluate their clients’ present financial standing and predict future results in light of the market’s trajectory. The Software development company of financial planning software that allows for the simultaneous analysis of live data and the making of immediate investment decisions has resulted in an improvement in communication between consumers and advisors.

As the software develops further, customers begin to operate it independently. Although not revolutionary, Personal Financial Management (PFM) software is seeing widespread use as a “Advisor Fintech” solution in the wake of the recent global financial crisis. Not only will it make it simpler for customers to handle their own financial affairs, but it will likely become the go-to location where both customers and advisory services can get all of the important information they need. Financial planning software of the future will have to cater to three distinct user groups, each with their own unique needs in terms of basic calculator for advisers, collaborative tool for real-time analysis and decision making, and personal finance app development management. And don’t forget about the meta-data we collect as a group to help with larger financial and commercial decisions.

Even so, the financial planning software’s most fundamental advantages can aid you in the following ways:

Improves Your Judgement and Action Plans

Financial planning software gives you the ability to reevaluate and revamp your fiscal processes. It lets you be preemptive in your decision-making rather than reactive. With this kind of programme, you can easily foresee the optimal strategy to maximise revenues and minimise expenditures.

Strategic Analysis and Planning Have Been Improved

Financial planning software for financial planners assists advisory firms and their clients in exploring “what if” scenarios, identifying potential sources of revenue growth, and calculating the likelihood of major external and internal factors by providing a shared platform for collaboration and personal financial management. These capabilities are the foundation of effective business techniques.

Fewer Errors

When comparing employing a smart software solution to hiring a person to do statistical analysis or deal with statistics, the latter is preferable for a variety of reasons. Businesses may improve their efficiency in planning and work by introducing smart solutions, which greatly lessen the likelihood of making mistakes.

Financial Transparency for Shareholders

The trust between you and your customers and advisers will grow if you all use the same software and provide everyone access to it. Successful financial planning requires access to data in real time, which will facilitate the making of rapid and swift judgments.

Create Specialised Financial Software Using CMARIX

As a result of the pandemic and the acceleration of online solutions, the financial planning software business is demonstrating a rapid upward trend of growth. This increase is occurring in the industry that develops financial planning software. According to the findings of a number of studies, it is anticipated that North America would account for the greatest revenue share in the industry. It is time to make the most of the chances that are now available.

An experienced Financial Software development services like CMARIX can help you create a platform that can act as a powerful collaborative tool for you to present your financial planning advice to clients. Whether you want to build one from scratch or upgrade the application you are currently using, the company can assist you in either of these endeavours. In addition, the bespoke software development services that we provide here at CMARIX are enhanced with cutting-edge and ground-breaking feature sets that are geared to assist your business in achieving its financial planning and development objectives.

Therefore, whether you are searching for a solution that is focused on your goals or your cash flow, the professionals that we employ will present a solution that is adapted to your prerequisites and anticipations. Please discuss your needs with our staff so that we can get your project off the ground as soon as possible.

You may like this: Build a P2P Payment App

Final Thought: Best Financial Planning Software?

Individuals wishing to automate and organise their money, as well as organisations of all kinds and phases, may benefit greatly from financial planning software. So, which is the most effective? Which financial planning software is the most comprehensive?

When it comes to financial planning tools, CMARIX hands down provides the greatest bang for your cash. CMARIX is the most complete financial software solution available, from automatic data aggregation to customizable dashboards.

There’s something to be said for a firm that’s as enthusiastic about its goods as CMARIX. With their industry-leading financial planning software, they provide top-of-the-line privacy and security solutions.

Frequently Asked Questions

What Fundamental Elements Should One Look for in Financial Planning Software?

Financial planning software allows you to simply enter data and generate extensive analytical reports, which may assist you in providing financial planning solutions to your customers. As a result, it must have characteristics such as-

Tax-aware tax planning

Budgeting and financial flow management

Planning for retirement distributions

Reporting in collaboration

Continuous planning with opportunities and recommendations

What Are the Various Software Solutions Used by Financial Advisors?

Financial advisers employ a wide range of software solutions.

Customer relationship management (CRM)

Portfolio management

Trading options

Analytics and investing