Do you have times where you lack funds for a big expense/investment? Well, apps like CashNow in UAE have become the go-to-stop for all who are looking for instant cash. Most top cash advance apps like CashNow provide quick approvals with less paperwork.

The Global Digital Lending Market is expected to reach 20 billion dollars in 2027 as mobile-based loan apps have increased their demand.

Are you in the lending and finance sector and wish to develop an instant loan app like CashNow? Let’s learn how to develop an instant loan app like solutions like CashNow in this loan app development guide 2025.

What is CashNow and Why Should You Develop an Instant Loan App like CashNow?

CashNow is an instant loan platform that provides users with instant cash advances, credited directly to their wallets or bank accounts. Its popularity stems from its intuitive user interface and rapid loan approval process.

Unlike traditional banks, apps like CashNow charge higher interest rates, which makes them highly profitable for businesses. This is why there is a high demand to develop an instant loan app like CashNow.

Why Build an Instant Loan App in 2025?

There are many reasons why building an instant loan app in 2025 makes financial sense. It is the perfect time to capture the market and establish yourself as a trustable modern lending company that keeps up with the times. Besides, you also get these advantages –

Rising Demand from Financial Institutions

The reason why so many companies want to develop an instant loan app like CashNow is simple. People don’t want to spend hours at a bank filling out paperwork when they need money immediately. Instant credit and quick approvals are made possible by lending apps.

Advance Technology Integration

Leveraging AI/ML can help in building instant loan app solutions even more useful than before. Features like personalized recommendations, automated credit scoring and others can streamline user experience and reduce cybersecurity risks.

Cost Efficiency

Compared to traditional banking systems, developing instant loan apps like CashNow results in lower operational costs. Automation reduces the need for manual labour which saves time and resources for both – bank and users.

Rising Demand for Instant Financial Solutions

Security has been the most crucial aspect of traditional banking. While it still holds an important place in online banking, customers today also want another important feature – speed. Quick loan disbursements, elimination of manual paperwork, and much more make instant loan app solutions a much more popular alternative in the financial software development industry.

Why is it the Ideal Moment to Build an Instant Loan App?

If you wish to build a loan app like CashNow, 2025 is the right time to get started for it. Instant loan apps are more so in demand than ever. The cost to create an app like CashNow can be significantly reduced by leveraging the expertise of a reliable mobile app development company.

Shifting Consumer Behaviour

To start, the pandemic has altered public perceptions of banks. More individuals would rather use apps to manage their finances than go to actual places. This change in conduct is becoming the new standard and isn’t a passing trend.

Financial Accessibility

Furthermore, rapid loan apps are really helpful when people are struggling financially. Many prospective borrowers are left searching for other options due to their stringent standards and drawn-out approval procedures.

How Do Instant App Solutions Work?

Create an investment platform where instant loan app solutions allow lenders to reach applicants and borrowers to receive loans. These real-world examples will help to gradually demystify the process.

User Registration

Users (borrowers) first create an account and enter personal information such as name, address, income, and identity.

Loan Application Development

After deciding on the kind of loan they require, borrowers complete a quick application. They might occasionally be required to upload simple documents, such as bank statements or proof of income.

Credit Evaluation

The app uses AI and built-in algorithms to assess the borrower’s creditworthiness and payback history. This may occur immediately or in a brief amount of time.

Approval Process

The loan is accepted if the borrower satisfies the lender’s requirements. Individual lenders may decide to finance the loan through fintech app development.

Loan Disbursement

Once you get the approval, the loan amount is directly transferred to the bank account. A few hours or days pass. The app allows borrowers to monitor loan status, create reminders, and make repayments. Lenders can effectively manage loan portfolios and keep an eye on repayments.

Explore the Process of Instant Loan App Development Like CashNow

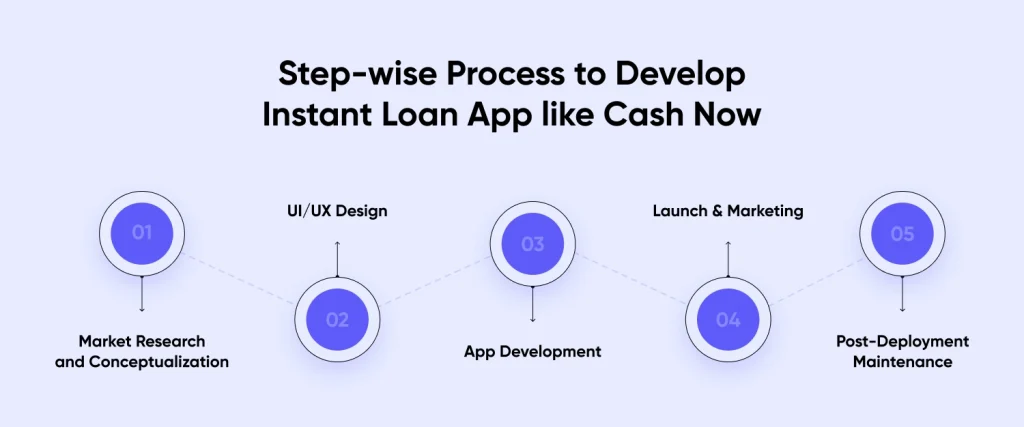

The development of instant loan app solutions is a multi-stage process, with each phase defining the final product and its cost. These steps describe the processes involved in developing a money-lending app and the expenses and tasks involved at each level.

Market Research and Conceptualization

Research and planning are the first steps in developing a loan lending app. It entails developing a basic app concept, identifying possible customers, evaluating rivals, and identifying market needs. The application’s security requirements and compliance regulations are another crucial factor that is taken into account at this stage.

UI/UX Design

The main focus while designing is to provide an appealing layout, user interface, and usability for the ease of the users. Designers should provide a prototype, a number of wireframes, and the primary layout of the application’s user flow in order to do that. Ensuring the application is responsive and aesthetically pleasing across all devices is crucial at this point.

App Development

Hire mobile app developers as they ensure the lending app is developed with all features and as per your needs during this stage. The backend is made to handle complex processes including loan approval and processing, loan payout, and loan repayment, among other things. On the other hand, the front is laid out and optimized to make the site easy to use and navigate. To add new functionality, this is where important third-party service interfaces are found, such as cloud storage, credit scoring APIs, and payment gateways.

Launch & Marketing

The launch, which entails sending the software for beta testing, comes after the development phase. Using marketing strategies to increase the app’s visibility and draw in its initial user base or audience members is another aspect of this phase. Asking beta testers for their opinions is also essential for improving the product before it is made public.

Post-Deployment Maintenance

To maintain an app’s long-term survival, regular maintenance and improvements are necessary during development. This could be done to address existing bugs, support system updates, or add new functionality that users have suggested or that new OS versions support. The term “maintenance” describes the routine modifications made to the software to keep it operating.

Features of Instant Loan Apps with Cost to Create a Loan App Like CashNow

How to know if your instant loan app like CashNow is actually covering all the important features for it to sell in the market? Here are some of the top features of instant loan apps that we ensure to implement or suggest to our clients from the finance sector.

CashNow App Development Cost(App like CashNow): Tabular Cost Breakdown 2025

| Feature | Description | Development Time (Weeks) | Estimated Cost (USD) |

| Personalization | Customizable features tailored to user needs. | 4–6 | $5,000–$10,000 |

| Loan Calculation | Real-time, dynamic loan calculator with advanced algorithms. | 3–5 | $4,000–$8,000 |

| Chat Assistance | Live chat support or chatbot integration to assist users. | 2–4 | $3,000–$6,000 |

| Document Management System | Secure document upload, verification, and management (e.g., IDs, bank statements). | 4–6 | $6,000–$12,000 |

| Automated Repayment Systems | EMI scheduling, recurring payment setup, and secure payment processing. | 5–8 | $7,000–$15,000 |

| Cloud Storage Integration | Scalable cloud storage for secure handling of financial data. | 6–8 | $8,000–$15,000 |

| Analytics and Reports | Advanced reporting and analytics tools for lenders and borrowers. | 4–6 | $5,000–$10,000 |

| Basic UI/UX Design | Intuitive and responsive user interface across all devices. | 3–5 | $3,000–$7,000 |

| Backend Development | Core infrastructure for loan approvals, processing, and repayment. | 8–12 | $10,000–$20,000 |

| Frontend Development | User-friendly customer interface with seamless navigation. | 6–8 | $7,000–$12,000 |

| 3rd Party Integrations | APIs for payment gateways, credit scoring, and other essential services. | 4–6 | $5,000–$10,000 |

| Testing and QA | Ensuring bug-free performance and security compliance. | 3–5 | $4,000–$8,000 |

| Deployment and Launch | App store submission, beta testing, and initial launch marketing. | 2–4 | $3,000–$5,000 |

| Post-Deployment Maintenance | Regular updates, bug fixes, and feature enhancements. | Ongoing | $2,000–$5,000+ /month |

Personalization

The cost to create a loan app like CashNow is directly impacted by the degree of customization needed. Development time and complexity will be greatly increased by highly configurable software that meets individual customer needs. The cost of development increases as adaptations get more intricate and user-specific.

Loan Calculation

Keep in mind that a loan calculator is one of must-have features of instant loan apps. Costs will likely go up, though, if sophisticated algorithms that can compute are included. Strong backend development is necessary for a dynamic, real-time calculator that adapts to user inputs, which raises the cost.

Chat Assistance

Despite the excellent user experience provided by fast instant loan app solutions, borrowers typically do not need a clerk’s help. Offering support and a live chat feature, however, can boost conversion rates.

Document Management System

Every app you create should include a system for handling several types of documents, including bank statements, IDs, and proof of income. An efficient procedure for uploading, verifying, and managing documents is essential, particularly to increase the loan approval rate.

Automated Systems for Repayment

The Equal Monthly Installments (EMIs) can be easily configured and repaid by consumers thanks to automated payback. The ability to schedule or modify recurring payments, for instance, and to include a system that can securely handle these types of payments adds more levels of difficulty to the application development process.

Integrating Cloud Storage

Cash advance apps like CashNow require cloud integration. This enables the safe and scalable storage of loan-related data, including financial records and borrower information. The cost of integrating and maintaining cloud-based systems into CashNow app development can be considerable, even though cloud services eliminate the need for physical infrastructure. This is particularly valid when handling substantial amounts of private information.

Analytics and Reports

Giving lenders access to comprehensive reporting and analytics is a useful feature, but it also makes developing loan lending apps more difficult. The application will need a strong backend.

Why Trust CMARIX as Your Preferred Mobile App Development Company?

CMARIX is the top mobile app development company with experience and knowledge in making amazing and unique apps. Our team is built up of highly qualified experts who can offer our clients customized, cutting-edge solutions.

CMARIX would be the best option if you want to find a trustworthy provider and discover the potential of the loan lending application industry. To discuss the details of your proposal and get advice on each step of the development process, you must get in touch with our professionals.

Conclusion

Building an Instant loan app like CashNow is a complicated process that needs to be tackled thoughtfully at every turn. Working with a reputable mobile application development company is essential to completing this phase successfully and accomplishing your business goals.

FAQs for Building Apps like CashNow

How much does it cost to develop an instant loan app like CashNow?

Building a loan app like CashNow may cost more than $50,000, and it could even cost $150,000 or more if you want to create a more complicated platform with features like AI technology for safe transactions.

How long does it take to build a loan app like CashNow?

Developing an instant cash loan app typically takes more than 6 months. However, depending on the platforms and complexities of the application, the first MVP can be developed in just 3-4 months.

What is the best tech stack for a loan app like CashNow?

A loan application such as CashNow can use a tech stack consisting of Python, Java, Ruby, C++, and C. The features, intricacy, and other aspects of the lending app determine the ideal tech stack.

What are the benefits of using AI in instant loan apps?

AI in instant loan apps can help in personalizing services and products, fraud detection, regulatory compliance, credit scoring, quick chat support with chatbots, and operational efficiency. It helps to enable transparency and reduce costs.