According to research, 1.31 billion users are using mobile payment systems for their cashless transactions this year. This is only one of the thousands of statistics reports circulated anytime the topic of mobile payments is brought up. And a bubble is too far away from being reached by these statistics. With Generation Z’s increasing propensity for it, the widespread acceptance of the technology will only become more mainstream.

Either investing in P2P Payment API integration development or introducing the in-app payment option is required for an app brand to be on trend not just in the current year but also in the years to come.

This post is intended for anyone who wants to include a “Click to Pay” option in their mobile apps. Your user might behave in several ways depending on the problem your software is intended to tackle.

So let’s begin.

Once you give customers the ability to make payments directly from the app, they will navigate through it in thismanner that will affect how your payment gateway is integrated.

What is a Payment Gateway?

Simply put, a payment gateway is a service that transmits data from a device to an acquiring financial institution (often a bank) to enable any financial transaction.

Apps for e-commerce, hotel and travel booking, grocery/essentials shopping, etc. require the use of payment gateways. Amazon, Groupon, H&M, and Paytm are just a few of the e-commerce behemoths that are among the top app developers for mobile shopping.

The payment channels they employ give customers an engaging shopping experience without the hassle of the traditional purchasing methods.

Things to Consider Before Mobile Payment Gateway Integration

1. Account Type

Dedicated and Aggregate accounts are the two different types of seller accounts.

Dedicated Account: This is a merchant account that is created just for a single merchant. The account is configured specifically to meet your needs for business transactions. Dedicated account implementation demands a substantial expenditure budget, which can be difficult for small-scale businesses.

The lengthy processing times for payments and a thorough investigation of company accounts deter consumers from using the account type, even if it provides for personalized account types.

The two Dedicated Accounts that are utilized the most are PayLeap and Authorize.net.

Aggregate Account: You can store your money in an aggregate account, which is a merchant account, together with money from other merchants. Dedicated Accounts also require your details, but this account type has a higher acquisition rate and a simpler approach overall.

The two most well-known and frequently utilized aggregate accounts that businesses use to deploy in their mobile apps are PayPal and Stripe.

2. Type of Product You Sell

The type of product you are selling through your app will determine the electronic payment system you select. Even though you’ll have integration choices when you offer actual goods. Selling digital goods can appear to be difficult.

When software is released through their storage, the App Store and Play Store prohibit using third-party e-commerce systems when selling digital goods. Your app can only conduct transactions using Apple or Google accounts that are exclusive to the platform.

3. Security Compliance (Certificates)

You will need to purchase a PCI DSS compliance certificate in order to lawfully handle the user’s personal financial information. One of the seven essential requirements for integrating payment gateways into mobile apps is this. You will need to obtain the certificate even if you are utilizing a reputable payment gateway like Stripe or PayPal. What happens in the process is

First, prepare the information system that saves user card data so that it complies with all PCI DSS criteria. The certificate will be given to you after your app system has undergone an examination by organizations approved by the PCI Security Standard Council.

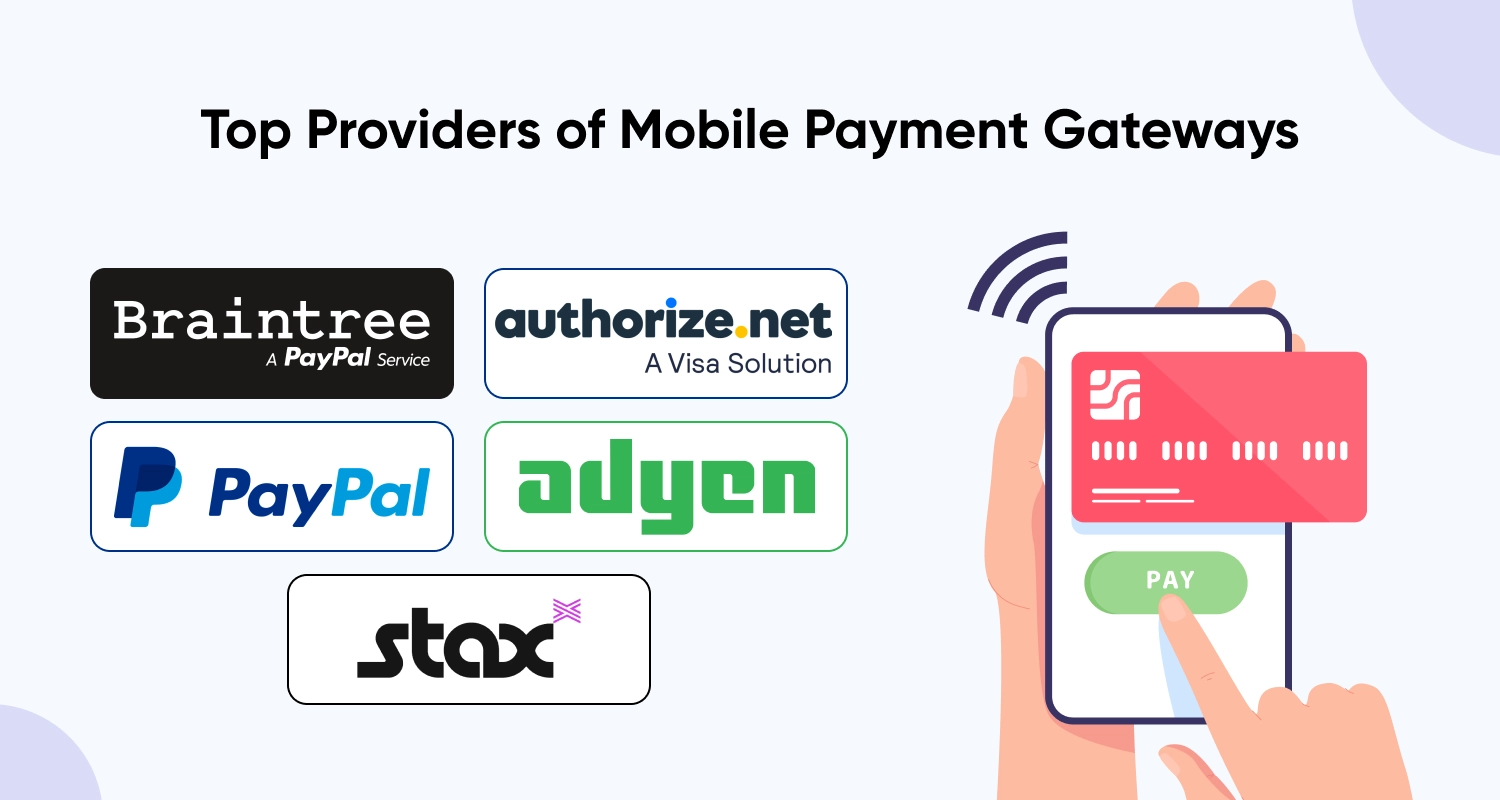

Top Providers of Mobile Payment Gateways

There are numerous options for mobile payment gateway providers. Some of the top payment channels for mobile app purchases are listed below:

1. Braintree

It’s straightforward to accept payments in your app thanks to Braintree’s simple API. Other advantages offered by Braintree include fraud protection and customer service.

2. PayPal

This popular company Paypal provides a comprehensive solution for online and mobile payments. Along with several features like recurring billing and customer assistance, it offers a reliable API.

Another well-known payment processor that provides a payment API is Stripe. Integrate Stripe payment gateway and avail offers like recurring billing, support for many currencies, and fraud protection. Additionally, it provides an SDK so that programmers can easily integrate payments into their apps using a small amount of code.

3. Adyen

Adyen, like the others, includes an API and all the capabilities, such as recurring billing and multi-currency support, you require to accept payments in your app. Additionally, it includes an SDK that makes adding payments to your app simple and only requires a small amount of coding.

4. Authorize.net

With an easy-to-use API and all the functionality required to accept payments in-app, including recurring billing and multi-currency support, Authorize.net is a well-known payment gateway in Canada and the US.

5. Stax

Stax is a mobile payment gateway that provides developers with an accessible API. It offers all the functionality, such as recurring billing and support for several currencies, that you require to accept payments in your app. With just a few lines of code, you can easily integrate payments into your mobile application payment gateway thanks to its easy-to-use SDK (software development kit). And it’s simple to keep your expenses down thanks to monthly membership payments.

Integrating Your Payment Gateway With Your Mobile App: A Step-by-Step Guide

Here are some general procedures to remember, while the specific steps for installing the mobile application payment gateways may differ from one supplier to the next.

1. Create a Merchant Account First

You must set up a merchant account with the business that manages your credit/debit card transactions, sometimes known as your payment processor. It is best for your payment processor and payment gateway provider to be the same company. By doing this, you may manage everything with a single system.

2. Open an Account With the Supplier of the Payment Gateway

Although your payment processor and gateway provider may be the same (for example, if you deal with Stax), this is a service provided by your payment processor. You will configure your account’s settings and link it to your merchant account.

3. Acquire the Required API Credentials

“Application Programming Interface” is what API stands for. The payment gateway will interface with your app to complete transactions using the payment gateway API.

You must obtain API credentials from the provider of the payment gateway before you can begin. This often involves initially setting up a test account in order to prevent processing real money while building and testing.

4. Set up the Payment Processor

Configuring the payment gateway comes next. You must choose the payment methods you wish to take, such as credit and debit cards, as well as any other features you desire, such as recurring billing or fraud prevention.

You may like this: Role Of Magento Payment Gateways In Magento Store Development

5. Integrate Your App With the Payment Gateway.

You can now begin writing code. The payment gateway provider will provide you with the required documentation and code snippets to get you started.

To handle the process of sending transaction data to the payment gateway and receiving confirmation back, you must incorporate the code into your app.

The procedures for integrating your payment gateway are basically the same for Google’s Android app and Apple’s iOS app. Although the programming languages may be different, the procedure is the same.

- Using the Drop-in UI, Begin Accepting Cards

Only a few lines of code need to be added to your app’s code to implement the Drop-in UI. They will provide you with this code.

- Create a Client Token on Your Server

The Drop-in UI is initialized with a client token, a secure identity. Your server generates this token, which is then given to your app. You ought to create a fresh client token for each launch of a new app.

- Check the Integration.

It’s crucial to test the integration after you’ve finished it to make sure everything functions as it should.

6. Release Your App After Integrating the Payment Gateway.

You are prepared to launch the app payment gateway integration after testing is complete and you are confident that everything is functioning as it should.

Keep this in mind:

- Depending on the payment gateway provider you choose for the mobile app, the processes could change a little.

- Before selecting a payment processor or gateway, it’s crucial to speak with your developer or development firm because they will be responsible for integrating and handling end-to-end mobile app development services into your app.

- Before releasing your app, be sure to thoroughly test your integration to prevent any problems with payment processing.

The Stax API is the best choice to develop payment gateway integration into your mobile app. We provide a full set of tools to make it simple for you to create, test, and release your app. Additionally, our complete payment processing platform takes care of all of your online, in-store, and mobile payment processing requirements.

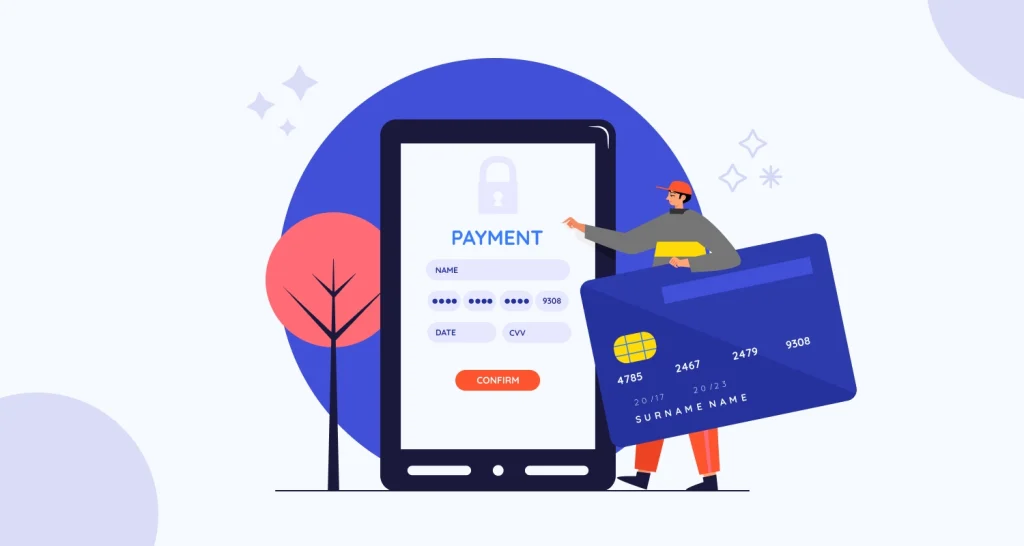

Payment Gateway Integration Through Debit and Credit Cards

Some payment gateway providers allow users to use the mobile app’s API to conduct financial transactions using debit or credit cards. Users can upload their credit or debit card information directly to the retailer’s checkout page using API-hosted payment gateways. Payment processing uses HTTPS or API requests. There are benefits and drawbacks to integrating a direct credit/debit card payment gateway. Let’s take a closer look at them.

- The possibility of customization. The user interface and experience of the payment processing Integration capability are entirely under the merchants’ control.

- It can be used with a variety of mobile devices, including smartphones and tablets.

- All necessary steps are in one place. Without ever leaving your app, customers may order and pay for things.

Disadvantages

- The security of payment transactions must be completely ensured by the merchants. They should obtain an SSL certification and PCI DSS certification for this reason.

- They must ensure the security of electronic transactions when integrating the API.

- The retailers are also responsible to handle issues related to customer fraud and data breaches.

Conclusion

The payment gateway integration cost depends on the solution and platform that you choose. It takes time and effort to choose a payment gateway solution that satisfies your needs, just as it does to integrate a payment system.

Now that your requirements are clear, you know how to incorporate a payment gateway into your app and where to begin. You also know what the first step in ensuring safety and security, which are crucial when making purchases and selling things on a mobile app, should be. If you wish to offer your users integrated payment processing, you can benefit from our experience in setting up payment gateways.

Frequently Asked Questions

What Is Payment Gateway Integration?

A payment gateway is a transaction processing software that collects, saves, and sends consumer credit card data to the acquirer. The customer is then informed of the acceptance or rejection of the payment. In other words, the payment gateway acts as a mediator between clients and merchants.

How to Make My Payment Gateway?

After selecting a product, the customer travels to the payment page and enters their bank information.

The payment gateway receives the entered information. Along with payment information, the payment system also accepts order numbers, store addresses, etc.

The acquiring bank, along with networks like Visa, Mastercard, and AMEX all make requests to the payment gateway to authorize the transaction. The system is therefore aware that the card is valid.

A one-time SMS password will also be sent to the cardholder if the merchant supports 3D-secure technology.

After processing the data, the issuing bank sends the information to the payment system and verifies its accuracy.

The issuing bank validates the transaction and verifies the availability of the necessary amount to be debited.

Following that, confirmation of the transaction is sent to the payment gateway and acquiring bank. The seller is informed that the deal went through without a hitch. Money is taken out of the client’s account and transferred to the merchant after that.

How to Integrate Payment Gateway in Android App?

Install Stripe SDK

Establishing a transient key

Establishing a CustomerSession

Configuring a PaymentSession

Beginning the payment

Including a means of payment

Verifying a purchase

The PaymentListener is added

How Does a Payment Gateway Function as a Mediator Between Clients and Merchants?

A payment gateway collects, saves, and sends consumer credit card data to the acquiring bank. Once the data is processed, the customer is informed of the acceptance or rejection of the payment. Essentially, the payment gateway facilitates the communication between the customer’s bank and the merchant’s bank, ensuring that transactions are processed securely and efficiently.