In spite of all odds, the worldwide insurance industry is predicted by Statista to reach $8.4 trillion by 2026, positioning it as one of the major participants in the digital business scene.

The insurance sector maintains several points of contact with its customers. Technology is advancing rapidly. As a result, the insurance industry has launched many new digital products.

Insurers are adapting to the digital age. They are using the best mobile app development services and technology to improve customer interactions. This shift enhances customer satisfaction and streamlines processes. Even today’s consumers are used to using the best mobile app development services online thanks to this change in the economic environment, and insurance products are no exception.

In light of the varied nature of operations, mobile insurance apps for consumers and insurance agents retain a certain level of sophistication while assisting in raising customer satisfaction, user engagement, and sales. For insurance firms considering an investment in insurance mobile app development, there are many additional advantages. You would undoubtedly need a mobile app development guide in line with the requirements of the insurance sector in order to investigate these benefits.

In this blog, you will learn about insurance app features. You will also discover insurance app development costs. Additionally, you’ll find out how to create a mobile application for insurance. This information can help you grow your business.

Why Is a Mobile Insurance App Necessary?

Having a mobile app for insurance designed for your business streamlines daily operations by enabling quick and easy contact between clients and insurance companies. Because of this, having a mobile app for your insurance firm has become crucial in this day and age. It accomplishes this by eliminating paperwork and automating time-consuming processes:

Insurance firms at the top of the pyramid can benefit from insurance mobile app development in the following ways:

1. Create a Customer Relationship

Compared to earlier times, consumers spend their money more wisely now. Insurance mobile apps are quite good at persuading users. The insurance mobile app development can get immediate assistance when they’re in need.

2. Expand User Reach

Professionals think that offering excellent customer service and converting customers into business associates is a fantastic idea. Referral programs can help you attract more customers as long as your insurance app development services are cutting edge.

There are two advantages to this. First, insurance agents would have more time to focus on larger, more desirable clientele if customer recruitment cycles were optimized. Second, you may use semantic marketing to target more customers by promoting your mobile insurance platform in apps that are relevant to it.

3. Examine Client Information

The insurance sector has access to mobile analytics, which allows for unprecedented levels of analysis. The following kinds of structured data are simple to collect with an insurance app:

- Identity Data

- Quantitative Data

- Descriptive Data

- Qualitative Data

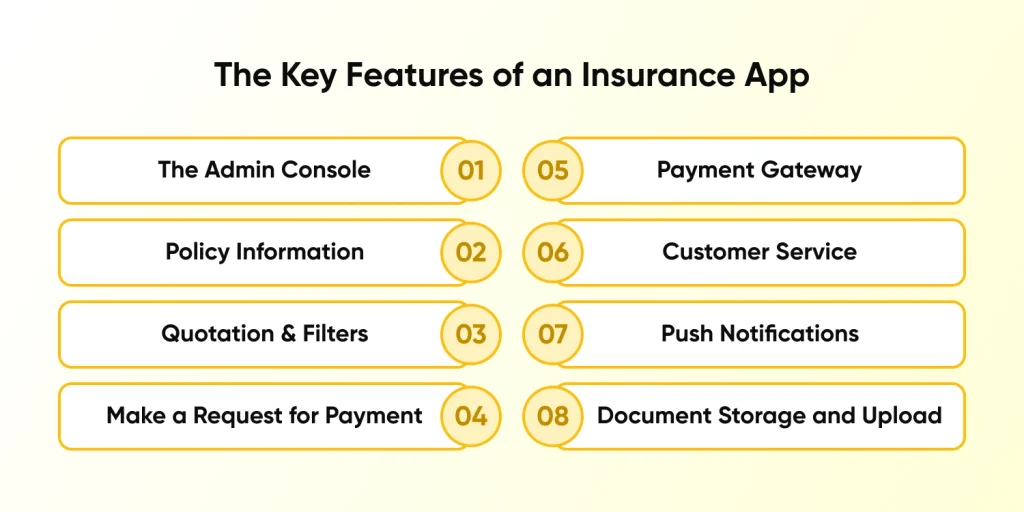

What are the Key Features Of An Insurance App Development

Enumerating the shared characteristics present in each of the aforementioned groups is crucial. These characteristics create the framework for a broad application manual for Fintech app concepts. With the exception of a few niche requirements, the following characteristics are constant and necessary, particularly if you want to create an insurance app:

1. The Admin Console

This is the introduction page where the insured person’s basic details are shown. Make sure the call-to-action buttons are visible and the design is clean and lean. Consider the Geico insurance application. Since it’s an auto insurance app, details about vehicle IDs, roadside help, payment buttons, and the ability to alter policies are all displayed on the profile page.

2. Policy Information

This page, which is included during the building of a mobile app for auto insurance, shows the specifics of the policy, how it works, and how much you may benefit from it. Using the same example again, Geico is an auto insurance app available for iOS and Android devices. It shows details on many plans that a single user can enroll in, such as one for a bike and another for a car.

3. Quotation & Filters

When developing an insurance app, a few essential things to consider are quotes and filters. The app has a function called Quote-tab where it may pull your information from its database and provide the cost of a policy or put you in contact with an insurance agent. If the insurance app development business is equipped to work with Big Data, it can offer clients greater perks or lower costs based on how frequently they inquire about or look into new products.

4. Make a Request for Payment

The step of insurance web app development that is still given the most priority is integrating a claims-filing area. Uploading proofs ought should be as easy as snapping a photo using the phone’s camera or the app’s scanner. Better still, if the procedure can be completed in its entirety on one page.

5. Payment Gateway

There’s no denying that the inclusion of a payment gateway is an essential component of developing any kind of insurance mobile app. The gateway should be able to accept payments from all major network providers, such as Master Card, Visa, and others. Providing one-click payment options or automated EMI billing is crucial for developing insurance software that attracts a large user base.

6. Customer Service

Chatbots are becoming commonplace. For common questions, automated answers serve as a convenient solution. However, what about unintentional events? One cannot expect a user stuck with a broken car to rely on pre-feeded responses.

7. Push Notifications

Let alone insurance firms, businesses often don’t pass up chances to join new markets. Should the need arise, the latter may even modify its business models. Both you and your customers require a reason to give away free things and purchase your merchandise. As a result, notify recipients via push notifications on a regular basis about their outstanding balance and any new policies that they can replace their existing ones with.

8. Document Storage and Upload

If you were to create an insurance app and it didn’t have a photo, how would the user upload their documents? The mobile app must enable document import-if necessary-from external servers, such as email servers, in addition to uploading documents from local file directories.

Challenges That an Insurance App Development Can Solve

You would concur that using an insurance software program makes working with the insurance business easier for users. Let’s examine the primary concerns that the client insurance app can finally resolve:

1. The Gap in Omnichannel

In order to engage with potential customers, insurance companies frequently use agents and brokers at strategic touchpoints. They are unable to promote profitable growth and provide a customized experience, nonetheless. Creating an app gives every Custom Insurance Software Development Company the most convenient way to connect and interact with their tech-savvy clientele.

2. Inadequate Data Security

Data related to insurance must be protected since it is sensitive. There is a chance that hackers could be able to obtain this data through conventional methods and techniques. Appointing a seasoned insurance mobile application development company as a partner will guarantee appropriate data security. It would make it possible to reduce operational risks and prevent fraud and data leaks.

Professional insurance app developers use contemporary technologies to adhere to the most recent safety regulations of on-demand app development. It would cover secure SSL connection protocols, biometric authentication, multi-factor authentication, and more.

3. Smooth Data Exchange & Availability

The company’s reputation suffers greatly when the insurance portal goes down in an emergency and there isn’t a backup plan. Your insurance app development firm can help you avoid these problems. They ensure continuous business continuity by providing an operationally dependable platform. Depending on your company’s requirements, they can assist you. Hire mobile app developers who can help in selecting between reputable cloud service providers. Options include Microsoft Azure or Amazon Web Services.

Looking at The Cost To Build An Insurance App

The complexity of the app can greatly affect the cost of creating an insurance app. The project’s goal also plays a significant role in determining the cost. Its features and design are crucial variables as well. The platform on which the app will run impacts the overall cost. The hourly rates of the development team further influence the cost. As per reports, the development overall ranges from $33,000 to $55,000. Costs vary based on features, complexity, and development team expertise Customization needs can also increase the cost significantly.

Conclusion

The digital revolution is happening in the insurance industry. In this transition, mobile apps are essential. Developing mobile apps can enhance client experiences. It also optimizes workflows and boosts competitiveness. Companies keen on app development can expand their audience. They can improve customer experiences in a growing market.

Frequently Asked Questions

How Much Time Does It Take to Develop an App for Insurance?

It can take nine or ten months to finish an extremely complex program with plenty of features. This timeline includes designing, developing, and testing all functionalities thoroughly. Therefore, project planning and milestone tracking are crucial to ensure timely delivery and quality assurance.

Why Develop an Insurance Mobile App?

An insurance smartphone app streamlines processes by making communication between companies and clients easier. Insurance firms must-have mobile apps in this day and age. Such apps facilitate rapid interaction and streamline daily operations, enhancing efficiency.

What Is Mobile Application Development Cost?

App insurance development costs vary, generally ranging from $15,000 to $50,000. This range depends on the scope and complexity of the project. A simple program includes basic user features like restricted management, a dashboard, login system, and user profile functions.

How Can You Locate the Best Company to Design an Insurance App?

Hiring a mobile app development team with relevant industry experience is advised while choosing the best app development agency. Examining platform reviews is a good technique for locating such a team. The mobile app developer insurance provides sophisticated filters. After that, all you have to do is get in touch with their past customers to learn more about how they collaborate. Make your last selection by getting in touch with the most trustworthy candidates after giving them due thought. This strategy will guarantee a successful and efficient app development process.