Mobile payments are gaining importance globally. This trend is especially prominent in regions like East Africa. Here, MPESA dominates the digital payment landscape. Integrating the MPESA API into a mobile application can greatly benefit businesses. It allows them to offer a convenient and secure payment method to their users.

In this blog, we will discuss the theoretical aspects of MPESA API integration for mobile apps. This integration is essential for mobile app development. We will explore the basics of MPESA and its benefits. This guide will help you understand the essential steps without delving into coding.

What Is MPESA?

Customers can use the M-Pesa mobile banking program. They can transfer and save money using their phones. It also enables them to pay their bills with ease. Users can also save or borrow funds via mobile phones. Over time, MPESA has undergone substantial change. It is currently among the most extensively used mobile payment methods worldwide. This is particularly true in East Africa, where a sizable user population resides. Due to their widespread use, mobile payments have become increasingly significant in the area.

Technical Requirements for MPESA Integration

Make sure that your mobile app satisfies the prerequisite technical requirements before integrating MPESA. These requirements involve securing the necessary credentials and setting up the right environment.

MPESA API Credentials

To begin the integration, you’ll need to register for MPESA API credentials. This involves setting up an account with Safaricom (the operator of MPESA). Upon registration, you will receive the following essential components:

- Consumer Key and Secret: You authenticate your API calls using the consumer key and consumer secret.

- Shortcode: This is a unique identifier for your business account.

- Lipa na MPESA Online and Paybill Account: These options allow businesses to collect payments either directly from customers or via their business accounts.

API Endpoints

MPESA has several API endpoints that serve different purposes. Some common endpoints you’ll interact with include:

- C2B (Customer to Business)

- B2C (Business to Customer)

- Transaction Status API

- Account Balance API

Understanding which endpoints are relevant to your application will ensure a smooth process of integrating Payment Gateway into the app.

Secure Connections and SSL Certificates

Data security is crucial in payment transactions. When integrating the MPESA API, all data exchanges should be encrypted. To secure communication between the app and MPESA’s servers, Secure Sockets Layer (SSL) certificates are essential.

Webhooks for Notifications

Webhooks play a crucial role in notifying your app about transactions. They inform you whether a transaction is successful or failed. Once a transaction occurs, Safaricom’s servers send a notification to your app.

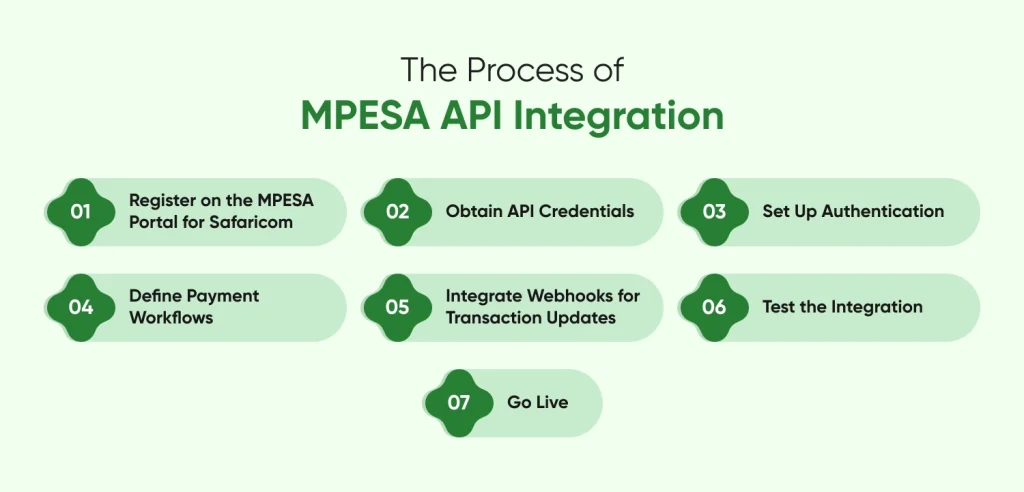

The Process of MPESA API Integration

MPESA API integration for mobile apps involves several critical steps. These steps ensure secure and efficient communication between the app and the payment system. Each step plays a vital role in the overall workflow. They collectively enable seamless mobile money transactions. Let’s dive deeper into each phase:

Register on the MPESA Portal for Safaricom

Making an account is the initial step in integrating the MPESA API. This account must be set up on Safaricom’s developer portal. Registration here is mandatory, as it allows you to list your app and begin the process of connecting your app with MPESA’s payment system.

A comprehensive information center is provided by the developer portal. You can investigate the features and capabilities of different MPESA API endpoints here. You can hire mobile app developers, useful tools, and resources after creating an account.

Obtain API Credentials

Once registered on the portal, the next step is obtaining your API credentials. These credentials include a Consumer Key and a Consumer Secret. Both are essential for your application. They ensure secure interaction with the MPESA API. Having these credentials allows your application to authenticate and communicate effectively with the payment gateway integration services.

Without these credentials, your app cannot communicate with the API. The Safaricom platform will generate these keys for you once you’ve registered your application. It’s essential to store them securely, as they form the foundation of your authentication requests.

Set Up Authentication

Authentication is a critical step when working with the MPESA API. It ensures secure communication between your application and Safaricom’s API Integration services. The API utilizes OAuth 2.0 for added security. This requires your app to send both the Consumer Key and Consumer Secret. These credentials are sent to Safaricom’s authentication server for verification. In return, the server issues an OAuth token.

Once you obtain this OAuth token, it serves as your app’s identity. This identity is crucial when communicating with MPESA servers. It’s essential to understand that tokens have an expiration period. Therefore, you’ll need to generate new ones periodically. If a token is invalid or expired, API requests will be rejected.

Define Payment Workflows

You must specify the payment operations in your app precisely before you can begin integrating the API. Choosing the transaction type that best matches your mobile app development company model is crucial because MPESA offers a variety of transaction kinds.

Each workflow has its own API endpoints and configurations. For example, in the Lipa Na MPESA C2B workflow, you need to configure the endpoint for payment processing, while in the B2C workflow, you configure disbursements.

Integrate Webhooks for Transaction Updates

Webhooks enable instant communication between different systems. When a customer makes a payment, a notification is sent promptly. This notification informs your app about the transaction status, which could be either successful or failed.

To receive these notifications, you need to provide a webhook URL that MPESA’s servers can call. This URL should be publicly accessible and secured with SSL encryption. This security ensures that sensitive transaction data is transmitted securely. Properly setting up webhooks is essential for your application. It enables your app to handle Mobile payments via MPESA and errors in real time. Additionally, webhooks allow updates to occur without the need for manual status checking.

Test the Integration

Before going live, it is important to thoroughly test your MPESA integration in a sandbox environment. Safaricom provides a sandbox that allows developers to simulate various payment scenarios, ensuring the integration functions as expected. This setup makes it ideal for API security testing purposes. Users can experiment freely, ensuring a risk-free environment.

Testing helps identify potential issues before they impact live users. This includes problems like incorrect API requests, authentication errors, or webhook misconfigurations. Additionally, you can monitor response times to gauge performance and secure MPESA API. It also allows you to observe how your app behaves under different circumstances.

Go Live

After completing the sandbox testing phase, assess your app’s integration with MPESA. Once you are confident in its performance, it’s time to go live. This stage marks the transition of your application from the test environment to the production environment.

In this stage, you will use the production URLs that Safaricom has provided instead of the sandbox API URLs. Additionally, ensure your OAuth tokens and webhook URLs are configured for the live system. Your app will be able to handle payments in real time once it is live, and consumers will begin to gain from the smooth iOS MPESA integration.

What are the Common Challenges in MPESA API Integration

The process of integrating MPESA API in Android may not always be straightforward. The following list of typical problems and solutions is provided:

Authentication Issues:

Many developers face issues when generating OAuth tokens for authentication. Ensure your Consumer Key and Secret are correctly configured, and your app uses the right token generation endpoint.

Webhook Misconfigurations:

If your app doesn’t receive transaction notifications, it may be due to incorrect webhook URL settings. Verify that your webhook URL is active and correctly registered in the Safaricom portal.

SSL Certificate Errors:

Secure communication is critical in payment systems. Ensure that your SSL certificates are properly installed to avoid data breaches and API request rejections.

Limited Documentation:

Safaricom’s official documentation can sometimes be hard to follow. Using third-party guides like those from StackOverflow or IntaSend can help you navigate these complexities more easily.

Top Benefits of Integrating MPESA API

Businesses integrating mobile app with MPESA payments into their apps enjoy several advantages, including:

Broader Market Reach:

MPESA’s dominance in East Africa ensures that your business can reach a wider audience, especially those without access to traditional banking.

Seamless Payment Flow:

The MPESA API allows for secure and instant payments, improving the user experience.

Improved Security:

The API ensures secure transactions by utilizing cutting-edge authentication and encryption techniques.

Cost-effective:

MPESA offers a cost-effective payment option by minimizing the need for credit card processing costs.

Conclusion

Integrating the MPESA Daraja API setup into your mobile app is crucial for targeting regions where mobile money is prevalent. MPESA offers a secure and scalable payment solution that enhances user experience with the right setup. Though challenges such as authentication and webhook configuration may arise, these can be addressed by following best practices and conducting thorough testing. This M-PESA API integration will lead to a smoother integration process.

MPESA’s dominance in regions like East Africa makes it a valuable tool for expanding your business. It helps provide convenient payment options for users, boosting engagement and satisfaction. By understanding the theoretical aspects of MPESA payment gateway integration, you ensure seamless implementation that benefits both your business and its customers.

Frequently Asked Questions

Can I integrate MPESA API into both Android and iOS apps?

It is possible to integrate mpesa API in mobile app development for iOS and Android. The API’s cross-platform compatibility enables users to transact with ease on various devices.

What are the types of MPESA APIs?

MPesa APIs come in several forms, such as the Payment API that manages payments and the Account Balance API that accesses account data. The Lipa na M-Pesa API for merchant payments and the Transaction Status API are examples of other APIs.

Is MPESA API secure for transactions?

Yes, the MPesa API uses strong security features, such as authentication and encryption methods. This guarantees the safety of user data during transfers and the security of transactions.

Do I need a business account to use MPESA API?

A business account is required to utilize the MPesa API. This gives you access to the functionality and tools required to handle payments and transactions.