Insurance companies when growing old need to handle increasing volume of data. But as the backend of an insurance company needs to deal with multilayered and growing volume of data, this often slows down the performance of the insurance company backend. This is why using time tested legacy software in their updated condition for the backend proves to be more effective than hiring finance development solutions for brand new software products.

Some of the common obstacles faced by backdated backend solutions in insurance companies include the following.

- When the backend solution finds it difficult to service existing products and makes it impossible for adding new products.

- When the backend under-performance forces your teams to get things done manually or take redundant steps or need to go through painful workarounds.

- When your inhouse IT group is tired of requesting new features for addressing evolving business needs.

- When adding IT resources is considered to be important but building a new solution from scratch is expensive and time consuming.

Building a Software Solution From Scratch is Challenging

It is common for the IT experts to go for brand new solutions, especially when everyone hates the old system too much. But considering the huge challenge it involves in replacing the legacy software with something brand new. A legacy software is built over a period of a decade or more and so replacing it would be a really challenging and big development project.

As your legacy software plays a critical role for your business, it is more apt to fix the shortcomings and update the software solution for present requirements. The legacy software modernization is the right approach to reduce risk and get faster results.

Read More: On-demand Insurance App Development: Key Things to Know

Why Carry Out Modernisation of Legacy Software?

Since software modernisation is crucial for your insurance business, consider the following reasons for doing so.

Reducing Risks

Not big stakes are involved in updating legacy software. In contrast while building a new system it would take a long time to develop and there can be several mistakes corresponding to definition, communication, or implementation of the system. This can cause additional delay in the launch of the entire platform. Moreover, there is no guarantee that the new system is going to be perfect right away.

Failure in timely delivery can cost a company millions besides raising questions on the CIO or CTO. In contrast, an agile modernization approach makes way for prioritization, iteration, and continuous improvement depending upon developing trust with the users and the decision-makers. Legacy software modernization to a great extent minimises risk, creates least work delay while allowing to deliver more value within the same timeframe and budget.

Fulfilling Requirement Gaps

The backend employees and company admin often feel frustrated with the performance and output of a backend which is outdated in respect of today’s insurance business practices. Sometimes this happens just because some of the features and functionalities in your old software have long been forgotten.

Now when building a new software there are always scopes that in a massive project, all the requirements will not be fulfilled . On the other hand, requirements continue to change. When a new system is developed, new features are likely to be added to the old one and these features will spark new issues. On the other hand, thanks to new features the software budget will run out of control.

Data Migration Issues

When you give your project to new software development companies, they will often feel glad to make estimates from a scratch. This development from scratch allows developers to create new clean and streamlined code. But the old system may hold a lot of relevant data hidden that your business continues to depend upon. Now this data migration to new apps can cause big problems. The new software may not accommodate the data correctly. There can be issues with the database schema resulting in breaking of workflows, enhanced frustrations mount, and resulting delays. This is where experienced migration services can come to your aid.

Difficulties in Transition

Irrespective of the quality of the design of your existing software most of your current employees know how to use it. Now by bringing a built-from-scratch system just over a few days can actually put the system in disorder. Even when the software works perfectly well, many simple tasks can even take hours to complete. If your teams are stressed and frustrated thanks to a new system they can’t handle properly, your business will have a bad impact due to this.

Key Things to Consider for Modernising Legacy Software

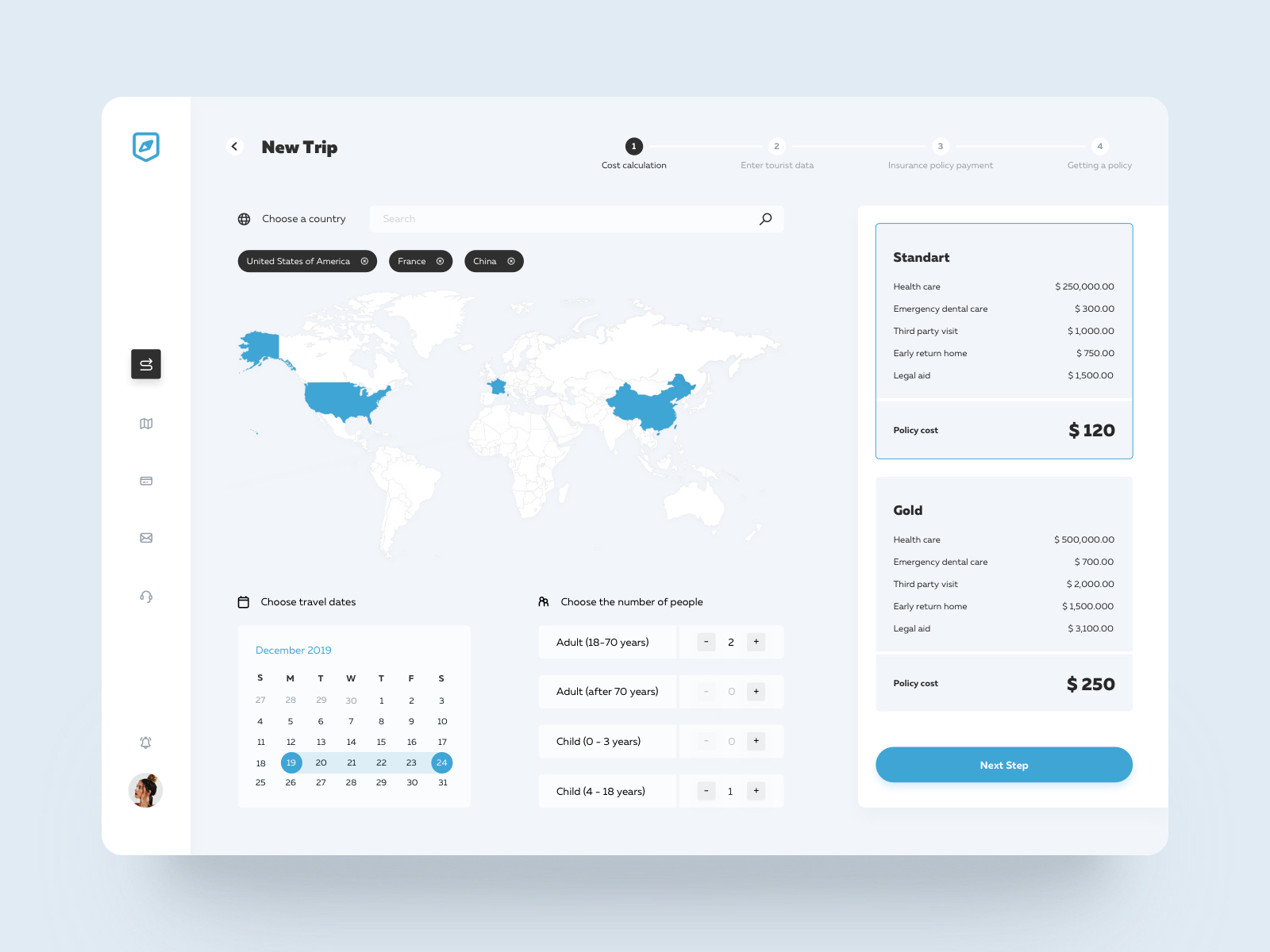

Instead of building from the scratch, you can now invite stakeholders to take advantage of modernization. Instead of replacing legacy software all at once, you can consider doing it in sprints. Start by breaking your wish list into a set of priorities and then develop each part in one. This is the way your insurance company can actually do away with expensive missteps and deliver real value. Consider the following aspects when modernising.

Keep Total Control

When doing modernization mindset you should be in total control. You should focus on the features that matter most to your stakeholders, agents, support, or underwriting teams. You need to ensure delivering value to those who need it most. Keep the momentum and respond quickly and make sure that the entire company doesn’t need to wait until the entire software is rebuilt.

Efficient Change Management

Modernisation also needs a step-by-step software redesign to give your employees more flexibility and room. You need to be prepared for both roll-forward and roll-back actions and should be able to manage the pace of change, level the spikes in the learning curve, and boost productivity. Since it is updating the existing software solution, everyone should get ample time to learn and level-up with the improvement of the platform.

Ensure optimum Value

Modernization of the software solution should also reduce up-front investment and ensure better speed in getting business returns after implementing the solution. By adopting a step-by-step software redesign, one can also avoid the depreciation in software capital investment.

Read More: Data Driven Dashboard for Insurance Companies: Key Principles, Metrics and Benefits

Conclusion

Most important of all, by modernising mission-critical software in your insurance company, you can unlock new growth opportunities. This Is why it is important to go into any development of any software project by keeping the risk factors in mind.

For ensuring streamlined modernisation, you need a budget to allow you modernizing the software features that your employees, customers, and stakeholders need. A software modernisation drive instead of putting everything into standstill or jeopardy should help making faster decisions along the way. Apart from budget, you also need steady access to development resources and the right skills for doing the job in the best fashion. In case you don’t have experts in-house, hire a software development company with relevant experience in the field of modernization of legacy systems.