Would you browse and shop from an ecommerce store with laggy payment processing pages? Or any site or mobile app that crashes during the payment processing? No, right? Well, that is exactly why, in today’s digital-led economy, having a secure, reliable and quick payment processing solution is a must for eCommerce stores, subscription-based apps or on-demand apps.

But, how to manage heavy transactions or concurrent requests without facing any downtime? Enter PayTabs.

PayTabs is an omnichannel payment solution for social commerce and ecommerce apps that support many platforms and payment methods with enterprise-grade security. Today we will guide you through a step-by-step process of PayTabs payment gateway integration in Android, iOS, and cross-platform apps like React Native and Flutter. We will also look into API-based integrations, benefits and how hiring dedicated developers can streamline the implementation process.

What is PayTabs Payment Gateway?

PayTabs is a PCI-DSS certified payment gateway solution used for supporting businesses for accepting digital payments with ease, and complete security. It is highly dominant in the Middle Ease and North Africa (MENA) region. This tool offers global capabilities with localized compliance and support.

It provides a versatile set of features including:

- Acceptance of credit/debit cards and regional payment methods

- Multi-currency support with over 160 currencies

- Invoice management, recurring billing, and refund handling

- Tokenization and anti-fraud mechanisms for secure transactions

PayTabs stands out because of its robust API, mobile SDKs, and flexible integration methods. Its unified dashboard allows real-time tracking of transactions, making it a trusted solution for startups and enterprises alike.

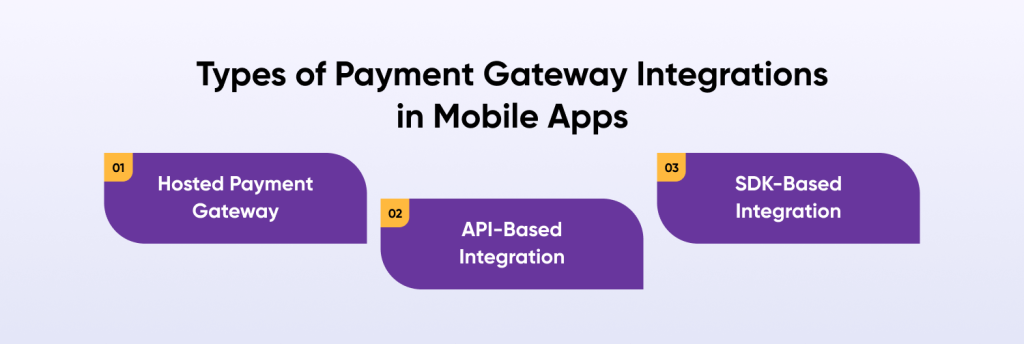

Types of Payment Gateway Integrations in Mobile Apps

It is important to select the right integration method for ensuring efficient PayTabs payment gateway integration in Android, iOS, or cross-platform apps. Choosing the right integration type depends on your app’s structure, data sensitivity, and desired user experience. Here are the types of PayTabs mobile payment integrations:

1. Hosted Payment Gateway

This method redirects users to a PayTabs-hosted checkout page. It is ideal for businesses that want a quick and secure setup without handling sensitive card data on their servers.

Benefits:

- Reduces PCI compliance burden

- Fast to implement

- High level of built-in security

2. API-Based Integration

API integration services gives developers complete control over the checkout experience. Payments are initiated from your server, and the app can open the payment page using a WebView or browser session.

Benefits:

- Full UI/UX customization

- Ability to implement custom workflow

- Flexible for complex logic (e.g., promotions, dynamic pricing)

3. SDK-Based Integration

PayTabs provides mobile SDKs that simplify payment integration. Available for Android, iOS, and Flutter, these SDKs support seamless in-app transactions.

Benefits:

- Secure and mobile-optimized flow

- Built-in support for multiple payment methods

- Easy post-payment callbacks and error handling

How to Integrate PayTabs Payment Gateway in a Mobile App

Integrating PayTabs into a mobile app isn’t just a copy-paste job. You need to hire payment gateway developers who have experience in integrating, configuring and customizing PayTabs and other such tools as per the client’s ecommerce store architecture. Here is a step-by-step guide on how to integrate PayTabs Payment Gateway in a Mobile App:

Step 1: Create and Configure Your PayTabs Merchant Account

To begin with, you need a verified merchant account on the PayTabs platform. Visit PayTabs.com and register your business to get access to your dashboard and API credentials.

Once registered, you’ll receive your merchant profile ID, server key, and client key. These credentials are crucial for establishing secure communication between your app and PayTabs’ servers. Inside the PayTabs dashboard, configure:

- Your domain and webhook URLs

- Accepted currencies and payment methods

- Callback URLs for successful or failed payments

This step lays the groundwork for integration and ensures all transactional events are routed correctly.

Step 2: Choose Your Integration Type

The next step is to select an integration model that best suits your mobile app’s tech stack, backend infrastructure, and compliance readiness. As we saw earlier, PayTabs supports multiple integration types for mobile applications. Here is a quick rundown on important comparison points between the three:

Integration Comparison Table:

| Integration Type | Ease of Setup | UI Control | PCI Compliance Scope |

| Hosted Checkout | High | Low | Minimal |

| API Integration | Medium | High | High |

| SDK-Based Integration | High | Medium | Moderate |

Choose your method based on how much control, effort, and compliance responsibility your team is prepared to take on.

Step 3: Add PayTabs SDK or API Dependencies

With your integration type finalized, the next step is to install the appropriate libraries or relevant PayTabs SDK for mobile apps:

Android Integration:

Add the PayTabs Android SDK to your project via Gradle. Configure permissions in AndroidManifest.xml, such as internet access and network state. The SDK supports various payment modes (Visa, MasterCard, Apple Pay via tokenization) and provides built-in classes to create the payment interface and handle responses.

iOS Integration:

Install the iOS SDK via CocoaPods or Swift Package Manager. Import necessary frameworks and handle transaction results with PayTabs’ delegate callbacks. Use built-in encryption and tokenization to process payments securely. The SDK supports both Swift and Objective-C.

Flutter Integration:

Use the official Flutter plugin by adding it to your pubspec.yaml. Configure platform-specific settings in Android and iOS folders, and use the provided Dart methods to initialize and process transactions.

React Native Integration:

There’s no official SDK, but integration is possible by wrapping the native Android and iOS SDKs using React Native bridges, or by using a WebView to open a hosted checkout or embedded API interface. This approach works best when you already have native dev support in your team.

Proper dependency setup ensures your app can communicate securely with PayTabs and handle payment events gracefully across different platforms.

Step 4: Configure Transaction Request Parameters

Once the technical setup is done, configure your transaction parameters before initiating any payment. This step involves setting up all the necessary fields that define the payment process, including:

- Customer information (name, email, mobile)

- Invoice or transaction ID

- Amount and currency

- Callback URLs

- UI preferences (like language or theme)

These parameters are either passed via SDK methods or REST API requests, depending on your integration type. Make sure the values are sanitized and validated to avoid payment failures or injection vulnerabilities.

Step 5: Handle Payment Response and Callbacks

Once a transaction gets processed, the team needs to capture and handle the result. The result can either be: success, failure or cancellation. PayTabs uses both: in-app (frontend) and server-to-server (backend) callbacks.

Frontend Handling:

Use SDK or WebView event listeners to show users the payment status immediately. This helps improve user experience and reduce confusion.

Backend Handling:

Configure your server to receive webhook notifications from PayTabs. Using these webhooks you get real-time transaction statuses and help keep your database in sync even if the user closes the app during the process.

Handling callbacks correctly ensures accurate order status updates, automated email receipts, and inventory adjustments for eCommerce apps.

Step 6: Test and Deploy in Production Mode

Before going live, conduct thorough testing using PayTabs’ sandbox environment. Test different scenarios like:

- Successful payments

- Declined transactions

- Interrupted sessions

- Invalid input fields

Use real card simulations provided by PayTabs in sandbox mode to test edge cases and verify backend processing. Once you’re confident everything works smoothly, switch the credentials from sandbox to live mode.

Ensure you also:

- Enable logging for error tracking

- Set up monitoring for callback failures

- Review PCI-DSS compliance guidelines for final checks

A fully tested integration guarantees a frictionless payment experience, reduced cart abandonment, and increased customer trust.

PayTabs Payment Gateway Integration in Android

For PayTabs payment gateway integration in Android, you use the official SDK. It helps you maintain a secure in-app transaction without redirecting users.

The Android SDK supports customizable payment pages, multi-currency support, and several payment options including Visa, MasterCard, and Apple Pay (via tokenization). It ensures a smooth user experience by keeping users within the app during the entire payment process.

Benefits:

- Seamless in-app payment flow

- Reduces cart abandonment by avoiding redirections

- Easy handling of payment status callbacks

This SDK is ideal for businesses looking to build scalable Android applications with secure, reliable payment processing capabilities.

PayTabs Payment Gateway Integration in iOS

PayTabs payment gateway integration in iOS is facilitated through a native SDK, allowing developers to add in-app payment features. Since SDK can integrate directly with the iOS ecosystem, the merchant will be able to provide instant secure checkout experiences to their end users.

The setup involves adding merchant keys, defining transaction details, and handling responses based on transaction outcomes (success, failure, or cancellation). Built-in encryption and tokenization ensure all sensitive data is handled securely.

Benefits:

- Native iOS experience with branding controls

- Secure token-based processing

- Multi-currency and regional payment support

For apps that demand seamless user experience and high performance on Apple devices, PayTabs iOS SDK delivers the right balance of security and flexibility.

PayTabs Flutter and React Native Integration

For developers building cross-platform apps using Flutter or React Native, PayTabs Flutter and React Native integration ensures you don’t need to sacrifice payment functionality for code reusability.

Flutter Integration:

PayTabs offers an official Flutter plugin, making integration simple. It supports common payment flows and dynamic billing fields, providing a native-like experience across platforms.

React Native Integration:

While an official SDK for React Native is not yet available, integration is still feasible using native bridge modules or WebView-based approaches. Developers can wrap Android and iOS SDKs within the React Native framework.

Benefits:

- Single codebase for iOS and Android

- Faster go-to-market for MVPs and startups

- Consistent UI/UX across platforms

This integration approach is ideal for startups and businesses wanting cost-effective and scalable solutions without compromising on features.

PayTabs API Integration for Mobile Apps

Payment gateway API integration offers ultimate flexibility. It’s a preferred method for businesses wanting a fully customized payment experience and complete control over the checkout process.

The process involves sending a payment request from your server using PayTabs’ RESTful API and opening the payment interface in the app via a browser or WebView.

Benefits:

- Custom checkout flows

- Dynamic transaction configurations

- High compatibility with existing backend systems

This method suits businesses with strong technical teams and backend infrastructure—especially SaaS products, marketplaces, and multi-vendor platforms.

Why Choose CMARIX for Payment API Integration Development Services?

Integrating a payment gateway like PayTabs isn’t just about plugging in an SDK or writing API call. As a leading mobile app development company, CMARIX also takes on the responsibility to make sure all transactions are secure, provide smooth user experience and agree with all regulations and compliances.

Hire payment gateway developers that match your business goals and user expectations. From startup MVPs and AIPoC services to full-scale enterprise platforms, our team implements secure payment gateways across various industries.

What Sets Us Apart?

- Full-Spectrum Expertise: From API-based integration to SDK implementation and hosted solutions, we cover it all.

- Security-First Development: We prioritize PCI-DSS compliance, tokenization, and secure data flow in every implementation.

- Cross-Platform Capability: Native Android, iOS, Flutter, React Native—we ensure optimized performance across platforms.

- Custom UX Design: We go beyond backend setup, building payment experiences that feel intuitive and on-brand.

- Agile Team Setup: Hire dedicated developers in India on flexible models to suit your project size and speed of execution.

At CMARIX, we don’t just integrate payment gateways—we optimize them to convert more users, reduce friction, and boost business growth.

Final Words

PayTabs offers a secure, scalable and reliable payment gateway API integration for mobile applications. It is also the ideal choice for the MENA region as we discussed earlier. While this service can be integrated easily with native Android and iOS systems, implementing it to React Native and Flutter can require expertise of a dedicated development team.

Get trust-worthy mobile app development services from CMARIX to never worry about compliance or future scalability. We have helped many eCommerce stores reduce their cart abandonment rates, unlocking the full potential of in-app payments.

FAQs on PayTabs Payment Gateway Integration Services

How to Integrate Paytabs Payment Gateway in Android?

You need to use the official PayTabs Android SDK for Integrating PayTabs in an Android app. It allows in-app payment processing with a secure and smooth user experience. The integration process includes adding the SDK to your app, initializing it with your PayTabs credentials, and configuring the payment details.

Steps include:

– Add the PayTabs SDK dependency via Gradle.

– Initialize the SDK with your merchant credentials.

– Set up the payment details like amount, currency, and customer info.

– Trigger the payment screen and handle the response using callbacks.

– This method keeps users inside the app and ensures security during the entire process.

How to Integrate the Payment System Into the Existing App?

To integrate a new payment system into an existing app requires proper planning so the app’s current functionalities don’t get interrupted. Start by deciding whether you want to use a hosted page, SDK or custom API integration. You can contact our professionals to get proper advice on how to proceed. Once that choice is clear, our developers can merge it into your app’s flow.

Key steps:

– Choose your integration type (Hosted, SDK, or API).

– Insert SDK or API methods into your current app architecture.

– Configure server-side logic if using API integration.

– Add payment trigger points in your app (e.g., checkout, subscription).

– Test the entire flow thoroughly to ensure accuracy and security.

In most cases, collaborating with experienced developers helps avoid compatibility or compliance issues.

How to Secure Online Payments With Paytabs in Android and iOS?

PayTabs supports both Android and iOS with dedicated SDKs, ensuring secure and native payment flows across platforms. You’ll need to follow platform-specific installation and configuration steps, but the logic remains quite similar.

For Android:

– Add the PayTabs SDK via Gradle.

– Configure payment details using Java or Kotlin.

– Trigger the payment screen and handle the result.

For iOS:

– Add the SDK using CocoaPods or manually.

– Use Swift or Objective-C to configure payment details.

– Handle the transaction results using delegate methods.

– This dual-platform approach ensures a consistent and optimized checkout experience on both systems.