Magento as the leading platform for building eCommerce stores offers an array of payment gateways. Choosing the right payment gateway is crucial as it takes care of one of the most essential aspects of the sales process. A payment gateway takes care of the entire process of transferring payment by connecting the customers, banks, and merchants. They also play a crucial role in securing customers payment and banking information by encrypting the data. Thanks to a highly secure payment gateway, an e-commerce store can prevent security risks like phishing and identity theft.

The Key Reasons Payment Gateways are Important

A quality payment gateway is important for an e-commerce website for many reasons. Let’s have a look at some of them.

- A quality payment gateway is crucial to secure customer’s payment and financial information through high-level encryption

- Reputed payment gateways are important to build trust and trust for the visitors of an e-commerce site.

- A high-performance, quick-loading payment gateway is crucial to deliver a better shopping experience.

- Quality payment gateways can help reducing instances of shopping cart abandonment.

How does a Magento payment gateway work?

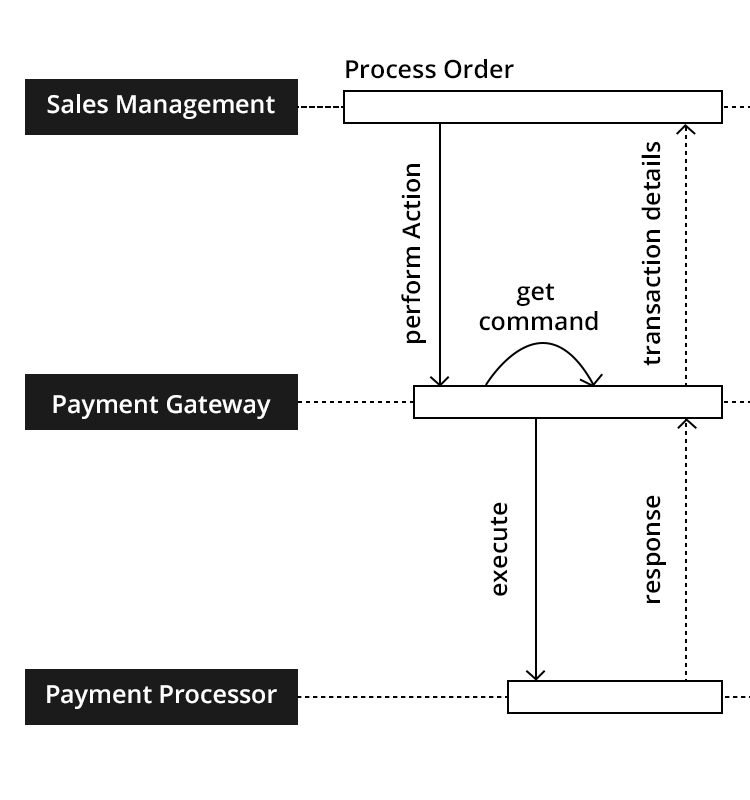

Most of the online shoppers are already used to instant checkout and payment processing. Naturally, the whole process of processing payment should not take more than a few seconds. Many of us actually think the payment page directly leads to the bank page, but actually, it involves a lot more complexities than this. Let’s see how a payment gateway in a Magento e-commerce store really works.

- As soon as the customer chooses a payment option, the payment gateway gets active and takes the transaction request. It then encrypts the payment information including the amount and sends it to the respective payment processor.

- Now, the payment processor transfers the same encrypted transaction information to the respective bank or financial company. The bank or PayPal like financial company make an assessment of the request based on the availability of funds and security parameters. Depending upon this they can either authorize or decline the transaction.

- The response of the bank travels the same way back to the payment gateway. After completing the entire payment process it notifies the customer with an on-screen message.

How to Choose a Magento Payment Gateway?

Payment information for an e-commerce store ranks as the most sensitive information as customers need to expose their financial information to third-party stores. Any instance of data breaches or security loopholes can completely destroy the reputation of an online store. Any of the top Magento development services with a credible track record will suggest the following considerations for choosing a payment gateway.

- Does the payment gateway offer quick loading time and fast-paced processing? Faster processing and performance are crucial aspects of good shopping experience.

- Is it accessible in all target locations and does it support all major currencies? For a store with presence across various locations and countries, it is a crucial criterion.

- Does it prevent false declines for cross border transactions? Many international transactions are declined just as they are seen to be more vulnerable to fraud.

- Are the default Magento payment gateways enough for your purpose? Apart from the default options, you have an array of custom payment gateways including Amazon Payment, Dwolla, Stripe, iPay, etc. For integrating methods such as e-wallets and prepaid cards, custom gateways can be good Options alongside the default ones.

Major Payment Gateways to Consider

Now that you have come to know about the key considerations for choosing the right payment gateways for your Magento e-commerce stores, here we explain a few of the most notable and reputed gateways invariably used by leading e-commerce stores.

- PayPal

Having a presence across more than 200 countries and the ability to accommodate transactions in more than 25 leading international currencies, PayPal is considered as one leading payment gateways.

- Braintree

Owned by PayPal this popular payment gateway is widely popular because of offering fast-paced one-click checkout process. This gateway also allows paying through latest modes like Bitcoin, Android Pay, and Apple pay.

- Authorize.Net

Owned by Visa this is one of the most trusted gateways known for providing most Advanced Fraud Detection Suite to ensure optimum security.

The Benefits of Having Multiple Magento Payment Gateways

With multiple payment gateway options, a Magento e-commerce store can enjoy a wide array of benefits. Let’s have a look at some of these benefits.

- With multiple gateways, you can cover the maximum number of people residing in various international markets.

- With several gateways, you can allow processing payment on a continuous basis as customers can choose one from an array of alternatives.

- By opting for payment gateways that allow processing latest modes like online payment app, e-wallet, bitcoins, and prepaid cards, you can be well-equipped for your tech-savvy, upmarket customers.

- With several credible and reputed payment gateways, you can actually build trust, security, and credibility of your store.

The Disadvantages of Having Multiple Magento Payment Gateways

In spite of the array of benefits having multiple gateways has its drawbacks as well. Let’s figure out these disadvantages.

- With too many gateways you will have less control on transaction cost. Small enterprises particularly can find it difficult to cope with several different ways to deal with transaction fees as charged by different gateways.

- More payment gateways will always lead to more administrative tasks like configuring several payment methods, managing contracts with the different providers and checking transactions and cash flows pertaining to each gateway.

Framework Options to Secure Magento Payment Gateways

While it is crucial to choose the most secure and credible payment gateway for your Magento store, the buck doesn’t stop there. For even a highly secure and fully compliant gateway you need to be vigilant about the choice of technology as well. Let’s briefly discuss these technology options alongside payment gateways.

Magento Secure Payment Bridge

If you are using Magento Enterprise Edition, by default you get Secure Payment Bridge. This is nothing but a separate secure server between the online store and payment gateways. The role of this payment bridge is to make sure that no credit card data ever enters the Magento web store. This security measure actually helps to tighten the security and preventive measures to reduce data breach.

The best thing about this server is that it is managed completely by Magento and this makes it even more secure. As for technical aspects, integrating this separate server protection involves some complexities that Magento experts will take care of for their enterprise edition clients.

HOP Integration

This option comes as a credible alternative to Secure Payment Bridge. Created and offered for the Magento stores by a payment gateway called Hosted Order Post (HOP) it actually collects the credit card information by using a special form on the gateway server.

In spite of the high-security measures, with this option, you have to compromise by opting for a hosted checkout page. For integrating HOP you also need to hire a Magento developer separately.

Silent Order Post (SOP)

This is another third-party security solution for Magento gateways that don’t force you to compromise with the look and feel of the checkout page. It supports almost all payment gateways and integrates the gateway-hosted payment form directly into the checkout page by using JavaScript. When sensitive payment data travels to the processing server through HTTPS, the data is not exposed to the server code of the web store.

This option is less secure because of the vulnerability of JavaScript manipulation but good for maintaining the preferred aesthetics of the checkout page.

Conclusion

Finally, no expert can suggest the payment gateways and technologies for your Magento store unless he is well abreast with your business, customers, and markets. So, the choice of payment gateways depends on a host of factors and there is no straightforward answer to this.