As mobile devices and mobile apps continue to penetrate all spheres of life including day to day financial transactions and business activities, eWallet app development is getting popular. In recent years, people have moved from traditional cash payment to advanced and faster payment processing techniques like internet banking and payment through cards. Now help the payment processing make further progress, e-payment apps have come into place.

eWallet mobile apps are too many and there are several of them. The success stories of e-payment apps such as Paytm, PayPal, Venom, PhonePe, MobiKwik, and several others continue to inspire other digital ventures to follow their examples. These apps together boast of millions of registered users and they continue to make mobile and web-based transactions an everyday reality.

According to the forecast report from the Market Research Future online payment app development thanks to the eWallet apps are supposed to experience a growth rate of 15% per year and is the market volume is likely to hit $2100 billion within 2023.

With so much promise on offer, building eWallet mobile apps are likely to become popular for years to come. If you are ambitious about building a highly engaging eWallet app, here we provide a meticulous guide explaining every aspect including the features, technologies, design and the future of such apps.

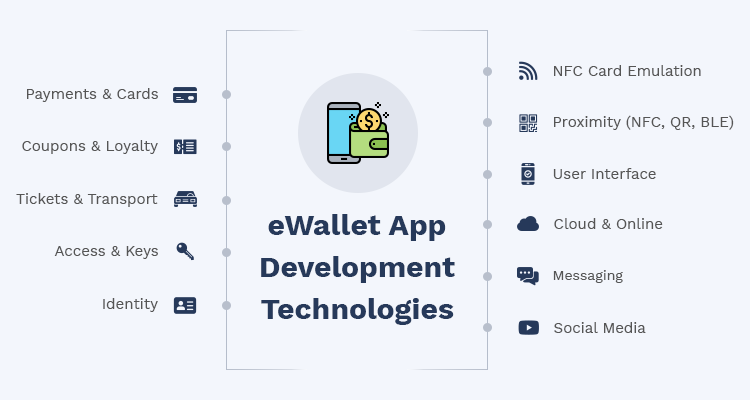

eWallet App Development Technologies

eWallet apps of today are more than just apps for making payments like mobile banking apps. eWallet apps are smarter and feature-wise superior boasting of advanced technologies like Near Field Communication, Bluetooth, Beacon, QR code scanning, and Blockchain.

Let us provide a shortlist of these technologies that any mobile app development company dealing with online payment will find helpful.

- The Near Communication Field (NFC) is an advanced technology facilitates the easy sharing of information and transferring money. The feature helps eWallet users to transfer money without the help of contacts.

- eWallet apps coming loaded with the QR code making payment extremely convenient and easy through scanning of the QR code.

- For making payments to people within close proximity, Bluetooth and Beacon technologies can also be used. This allows a faster, secure, and more trustworthy payment method.

- eWallet apps with the help of Blockchain technology allows transacting the cryptocurrencies besides helping with optimum data security.

- There can also be custom business based eWallet apps with more specific feature set and user experience attributes.

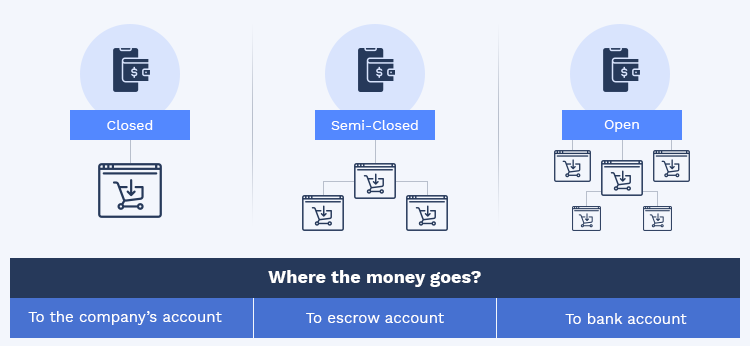

Different Types of e-Wallet

There are various types of eWallet apps that mostly differ from one another thanks to the payment processes they follow. With the help of our experienced mobile app developers we got a better understanding of the users let’s describe the various types of eWallet apps here below.

- The elementary and basic types of eWallet apps are from mobile service providers who allow transferring funds for various uses and making payments right from the mobile device. This type of eWallet app allows sending and receiving money through the service provider.

- The other important type of wallet is those that give users various types of discounts through SMS by using OTP.

- The most common type of e-wallet apps is the ones allowing making payments using the mobile web.

Key Features of eWallet Apps

Now we are going to explain the various eWallet app features. These eWallet payment app features can be grossly segregated into three different categories as we mentioned below.

- The user-focused features

- Admin panel features

- Value-added features

User-Focused Features

These features basically define and outline the user experience and user interactions within the eWallet apps.

- User Registration

First of all, like most apps across the niches the users need to register by creating an account. For doing this he needs to use his mobile number and the email id. He will get a verification code and after entering this code, he will be able to register the account. A few eWallet apps also provide a well-articulated KYC (Know Your Customer) process to ensure safe money transfer.

Banking Account Linking

At the very next step, the user needs to link his bank account details with the respective eWallet app. This account is where the transactions and payments will be carried out. Here the user needs to add the card details, corresponding CVV number, and the date of expiry mentioned in the card.

Putting Money into Account

Here users have the option of adding money to their wallet from the bank account they already added. This requires using the respective card details along with the 3D secure pin and password. They may need to use the ATM pin for adding money as well.

Sending Or Receiving Money

eWallet app allows users to send or receive money to and from anyone by just providing the recipient number or through scanning the QR code. As an alternative technology, NFC or beacon can also be used for facilitating such transactions. The process of receiving money follows a similar process.

eWallet Passbook

For an eWallet app, providing a passbook showing all user transactions in a historical format is important to maintain transparency and ease of search.

Back to Bank money transfer

Most of the advanced eWallet apps are also providing the option of making bank to bank money transfer in case he is reluctant to keep a lot of money into the wallet. This becomes essential for all those eWallet apps that come with a monthly limit of keeping money or making transactions.

Bill Payment and utility

eWallet apps also allow you to make payment for utilities and pay all your bills for different services such as phone bills, electricity, water tax, prepaid phone recharge, etc.

Paying for Insurance

The eWallet app also helps to pay the insurance premiums in a timely manner. This safeguards the users from late payment and corresponding charges and implications.

Flight and Train Reservations

eWallet apps also help to book the flight, train and bus tickets and journeys. While using eWallet apps you only need to provide the journey details and then follow the simple steps for making payment.

Grocery and Daily Needs Shopping

eWallet apps coming with all user-focused features allow making easy payment for groceries and daily needs. For almost all categories of items and purchases eWallet apps offer an extremely easy way of making payment.

Promotion with Offers

As there are too many eWallet apps in the market and there is tremendous competition, eWallet apps increasingly depend upon promotional offers and discounts to engage more customers and boost transactions. The offers and discounts are displayed within the app below every specific transaction or item.

Ratings and Reviews

Ratings and reviews come as crucial features through which you can actually give a boost to the discoverability of your app. The app simply can ask the user to provide a rating for the app and write a review describing His experience and satisfaction. This helps to influence other users who are still considering to use the app.

Order History

Order history within an eWallet app provides all the details of various orders and transactions made using the app. From paying a bill to the ticket booking to making a shopping mall purchase with the eWallet, all transactions are shown in the order history.

Language choosing

To make sure no person from a different language speaking community is left out, an eWallet app comes with a variety of language choices. This helps users to use their native language for carrying out transactions easily.

Round the clock support

An eWallet app needs to provide support to the customers throughout the day. This helps whenever the customer faces a problem regarding making a payment or carrying out a transaction by using the eWallet app.

Referring Friend

It works as a great promotional feature that helps an eWallet app to spread the word and become visible to a larger audience. This feature tries to motivate users by incentivizing the referring action from the user.

App Settings

Like any app eWallet app also needs settings that help to customize an app as per the user needs. The app settings will come loaded with different areas such as profile settings, payment settings, and security settings.

Admin Panel Features

Now that we have already explained the user-focused features, let us concentrate on the features and aspects that are crucial for the admin panel.

Dashboard

The admin panel is presented with a dashboard to take control of the user information and user actions and boost the usability of the app. Through the dashboard, the admin keeps a tap on all user activities and features.

User Profile Management

eWallet app-admin also manages the user profile and all transactions carried through the eWallet on a day to day basis.

Security enhancement

The eWallet app admin to maintain the trust and reliability of the app takes responsibility to enhance security settings and features. The app admin also evaluates the potential security lapses and maintenance of confidentiality.

Real-time Analytics

The eWallet app-admin tries to stay updated with real-time analytics to make way for more engagement and business conversion. App analytics helps the app admin to remain informed about the lapses, shortcomings and different feedback’s that it needs to work upon.

Add new users

App admin takes the sole responsibility of accepting and rejecting the user registration. While app-admin verifies the user profiles and registration data based on a number of parameters, any dubious profile having the possibility to indulge in malpractices can also be blocked by the admin from registering.

Value-Added Features

As of now, we have become informed about the principal features that make an eWallet app working. Apart from all of these, there are several other features that help your eWallet app to stand out from the competition. These value-added features will help to build an eWallet more user-friendly.

Push Notification Messages

Push Notification messages are the feature to help your app stay constantly in touch with the users in relevant contexts. The feature will allow the app to send important notification messages to the customers with promotional offers, coupons, discounts, etc. This feature also helps the user to remain informed whenever any amount is debited or credited through the app.

Geo-location

The geolocation feature helps in multiple ways. It helps the app to track the user location for making marketing offers based on proximity and secondly it helps to facilitate the transaction by connecting with the NFC terminal or similar payment processing systems.

Data syncing

This feature in eWallet apps provides great help in terms of security. The feature allows syncing the app data synchronized with the account details of the user. Thus makes authentication and validation extremely easier.

OTC

One Time Code or OTC is a crucial verification feature that helps to protect every transaction with an additional security layer.

Loyalty Programs

In eWallet apps the loyalty programs come as part of the promotional strategy for keeping the loyal app users engaged with the app. This helps to boost loyalty through cashback or reward points that can be redeemed later.

In-app Camera

The in-app camera is a key feature of eWallet apps. This feature helps to take and sending screenshots of transactions and payment processes as reliable proof. The in-app camera also helps in scanning the QR code of an eWallet app.

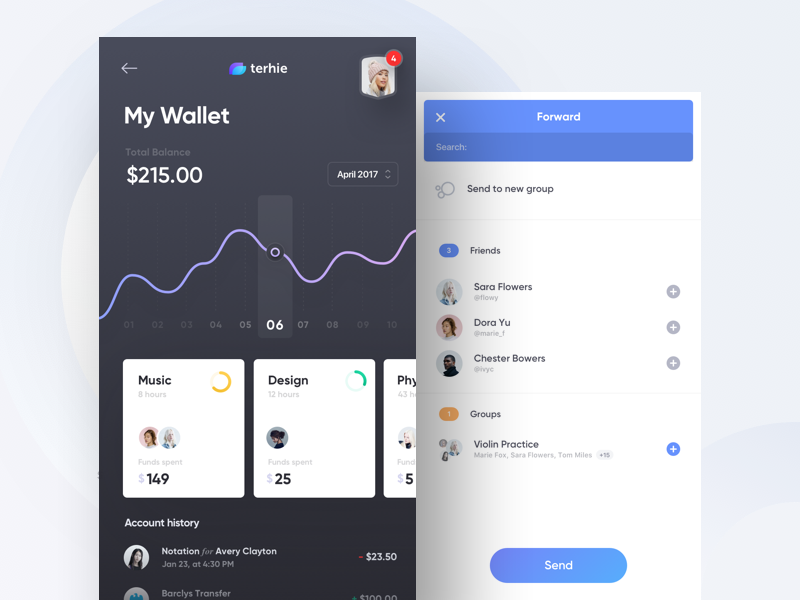

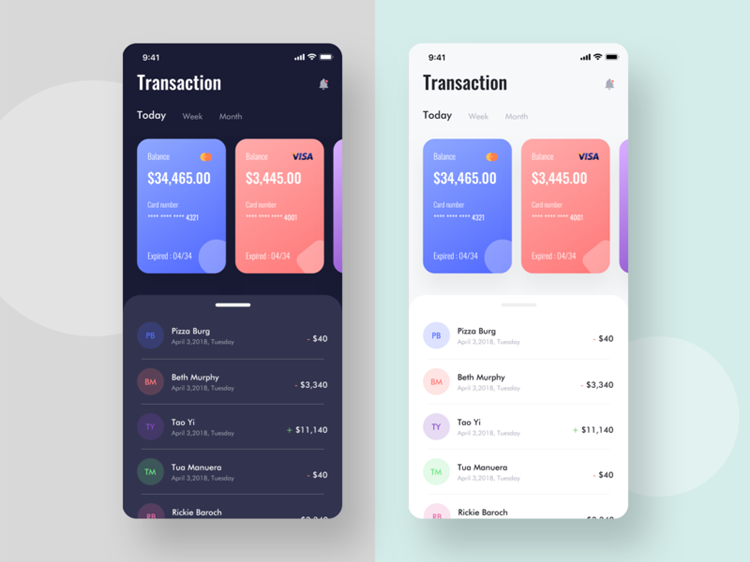

App Designing

When it comes to the user interface design of eWallet apps, you need to put a lot of effort together for a superior and user-friendly design. EWallet apps are one of those apps that are likely to give a complex interface thanks to a wide range of features and a variety of elements. This is why making the design simple, easy for access and engaging one is extremely crucial. Instead mixing and confusing with multiple segments, maintain a clear interface with every option and feature clearly visible.

Backend Development

As and when you are ready with the design, it is time to consider the backend or server-side development. This is the area where developers need to ensure using a good platform and a highly reliable cloud computing architecture. Since the app needs to store a huge volume of data in a secure manner, choosing the right architecture is extremely important for any mobile app development company.

How An eWallet Actually Work?

Now that we have explained all the technical details and various features, let us come to the very basics. How to use an eWallet app for making transactions and making payments in different contexts? To put it simply, how does an eWallet app actually work?

Well, much like paying through a net banking app, the eWallet app uses an agent or a payment gateway to transfer money from your attached bank account or receive money in the wallet from the same. In contrast to net banking apps, eWallet apps mostly focus on making transactions and payments instead of taking care of savings and investment. Whenever you make a transaction through an e-wallet app, a notification message is sent to you.

What Are the Key Differences Between The eWallet and Digital Wallet?

Let us remind you that eWallet and digital wallets are not the same. For example, PayTM is an eWallet while MasterPass from Citibank is a digital wallet. Digital Wallets basically work by saving the bank card information if the user for carrying out future transactions. This requires just validating the card information with the app for once and all. By authenticating with username and password the user can use the saved cards and make transactions. With this wallet, money remains in the user’s bank and credit card account.

E-wallets on the other hand, require loading money before carrying out any transaction. By loading money to these wallets, the user can go careless and make transactions. For this wallet to work the user needs to deposit money in the wallet app.

Masterpass, Google Wallet, Apple Pay, etc are examples of digital wallets. Paytm Wallet, Freecharge Wallet, Mobikwik, etc are Examples of eWallets. Only a handful of companies such as Paypal provides both eWallet and digital wallet apps.

What is the Future of eWallets?

Traditional wallets long ceased to remain useful as a tool to carry money and bank cards. E-wallet apps are increasingly becoming common tools for carrying all kinds of transactions. E-Wallet apps even made it extremely easier and speedier to make payments transactions online and offline. As the popularity of eWallet apps is growing the transaction volume is estimated to grow at a rapid pace.

Which Industries are Most Benefited by eWallet Apps?

Though eWallet apps because of their very nature are closely associated with the financial and banking sector, there are a number of industries that have been hugely benefited by eWallet apps.

Retail and e-Commerce: For customers to pay in retail and e-commerce stores, eWallet apps can provide a handy and efficient payment solution.

Banking and Finance: eWallet apps work closely in collaboration with the banking and finance organizations and solutions and provide the ease of accessing bank accounts, bank cards and processes for sending and receiving money.

Mobile Apps and Web: eWallet apps provide the most effective and efficient way to make purchases through mobile apps, make in-app and online purchases.

Logistics: eWallet apps help to streamline payment processing for logistical solutions and cargo services through integrated QR code and barcode tracking.

Transportation: In the transportation industry, paying toll taxes and making payments in the grueling stations became a lot easier thanks to the eWallet apps.

Healthcare: For making payment for healthcare services, medicines and medical equipment eWallet apps provide the most instantaneous method.

Telecommunications: Whether for paying telecom bills or making recharges for prepaid telecom services, eWallet apps can provide a handy means.

Conclusion

So, already the eWallet apps are pretty much into everything and they continue to make a bigger and better influence in allowing easy transactions and payment processing. No wonder, eWallet apps continue to be popular for businesses of diverse niches.